This guide to market capitalization will take you through everything you need to know about market cap, which is a key metric often used in the cryptocurrency market.

Many in the cryptocurrency community tend to think lower-priced coins have a higher probability to jump higher in value compared to more expensive coins. For instance, a coin worth $0.10 would multiply in value much more as compared to a coin worth $1,000. However, looking at price alone is a poor indicator of the actual value of a coin. The indicator that should be used instead is market cap.

What is Market Cap?

Market capitalization – or market cap for short – is a fancy term that indicates the market value of a cryptocurrency. It is also a measure of the size of the particular cryptocurrency; the higher the market cap of a cryptocurrency, the bigger the cryptocurrency is compared to others. Bitcoin is currently the largest cryptocurrency based on market capitalization.

(See more: Bitcoin vs Alt Coins Returns: Comparison of Gains Between Bitcoin & Altcoins Investing)

How Do I Calculate Market Cap?

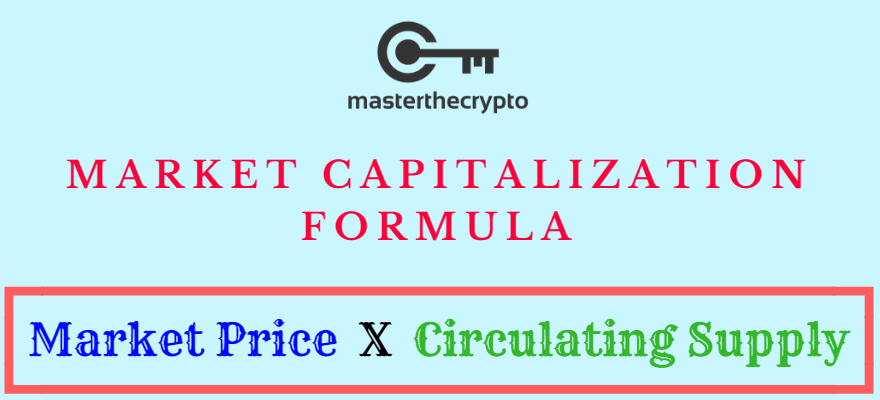

The computation of market capitalization is straightforward. The golden formula is:

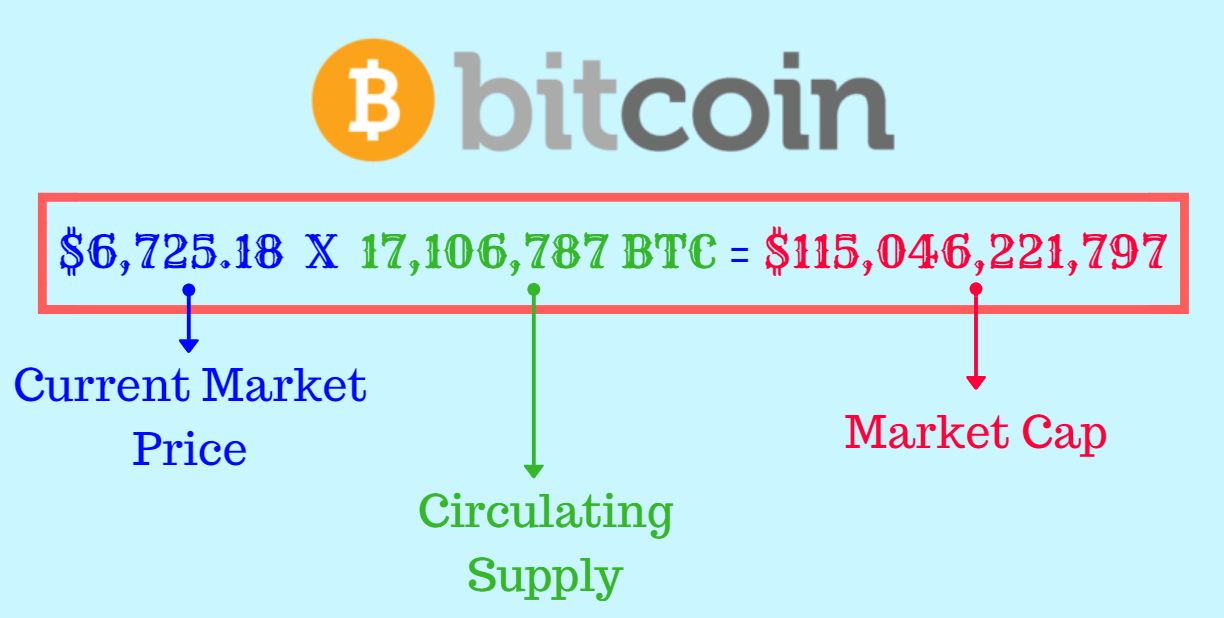

Market cap is computed by multiplying the current market price of a cryptocurrency with its total circulating supply. Let’s take a look at the computation of market cap for Bitcoin:

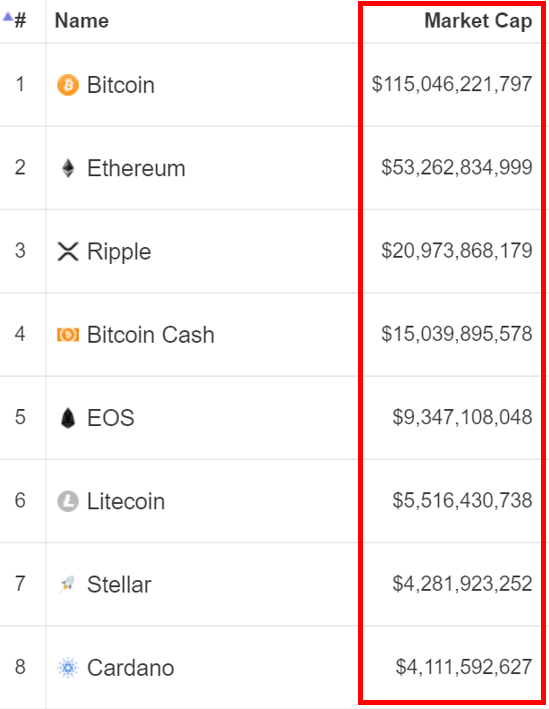

At the time of writing, a single Bitcoin is priced at USD $6,725.18 and there’s a total of 17,106,787 Bitcoin in existent at the moment, thereby giving a market cap of over $115 million. Since Bitcoin if the ‘founding father’ of cryptocurrencies, it is currently the largest coin with a dominance of close to 40%. This means that Bitcoin’s value makes up about 40% of the entire cryptocurrency market. (Read more: Is it Too Late to Buy Bitcoin and Is It too Late to Invest in Cryptocurrency?)

Let’s look at the 2 components further to have a deeper understanding:

1. Market Price

Market price refers to the price of the cryptocurrency according to current market rates. Simply put, it is the price where buyers and sellers agree on in the open market at a particular time. It is important to understand that the price of a cryptocurrency will vary across different exchanges, different currency pairs (fiat or crypto base currencies) and different countries.

You can see that the prices of Bitcoin (BTC) are never the same across different exchanges and different base currencies at one particular time. This is due to the differences in supply and demand dynamics that ultimately dictates the price of a cryptocurrency. For example, the price of a Bitcoin can be more expensive in a country where there’s little supply (due to a lack of sellers) to cater to higher demand from potential buyers, such as in Zimbabwe or Nigeria. The best way to find the market price of a coin is to look at its aggregate price, which is a single, average price of a coin across many different exchanges. You can access the aggregate price in cryptocurrency pricing websites like CoinMarketCap.

2. Circulating Supply

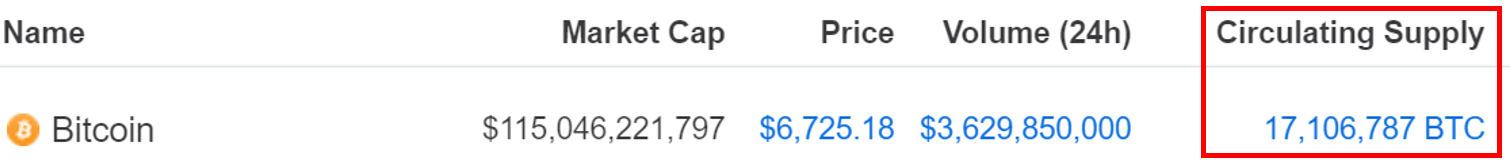

Circulating supply refers to the current number of coins in circulation globally. This is not to be confused with Total Supply, which is a completely different thing. Here’s a screengrab from CoinMarketCap to understand the difference:

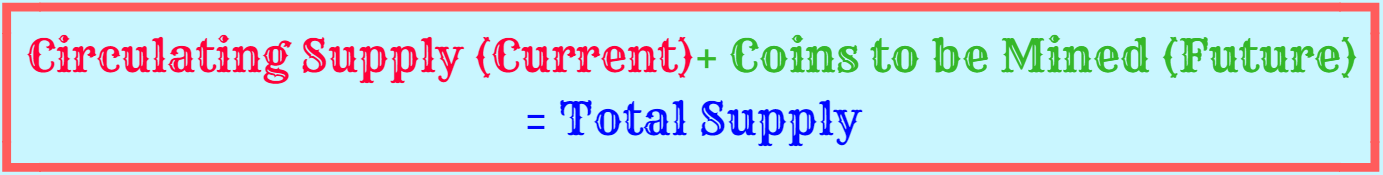

As can be seen, the current circulating supply of Bitcoin is 17,106,787 BTC. This means that there are over 17.1 million Bitcoins that are in existence at the moment, whether they’re being traded on an exchange, held in wallets or simply lost forever. Total Supply refers to the entire amount of coins that will exist according to the project, including coins that are yet to be in existence (mined).

In the case of Bitcoin, the maximum supply of Bitcoin that will ever exist stands at 21 million BTC. Due to the mining process, new BTC will be created up till the current supply reaches the maximum supply of 21 million, and there’ll be no more BTC left to be mined. At that point, the Total Supply will be the current circulating supply.

It is important to note that a majority of tokens are pre-mined, meaning that these tokens have already been mined at the outset of the project and there will not be any more tokens that will be created in the future. In that case, the total supply will be equivalent to the circulating supply. Here’s an article explaining the differences between cryptocurrencies and tokens for a more in-depth appreciation.

Types of Market Cap

There are 2 types of market capitalization metric for the cryptocurrency market: Market Capitalization for Each Cryptocurrency and Total Market Capitalization of Cryptocurrency Market.

1. Market Capitalization for Each Cryptocurrency

This category is dedicated specifically towards the market cap for each cryptocurrency. You can also find this information from CoinMarketCap.

Generally, a coin is ranked according to its market cap; a higher market cap means a larger size. Looking at the market capitalization of each coin is useful for assessing a particular coin, or even in comparison to other coins. If you plan to track the growth of the entire crypto market, then the next category would be helpful.

(See also: Category of Cryptocurrency Market: Pure Cryptocurrency)

2. Total Market Capitalization of Cryptocurrency Industry

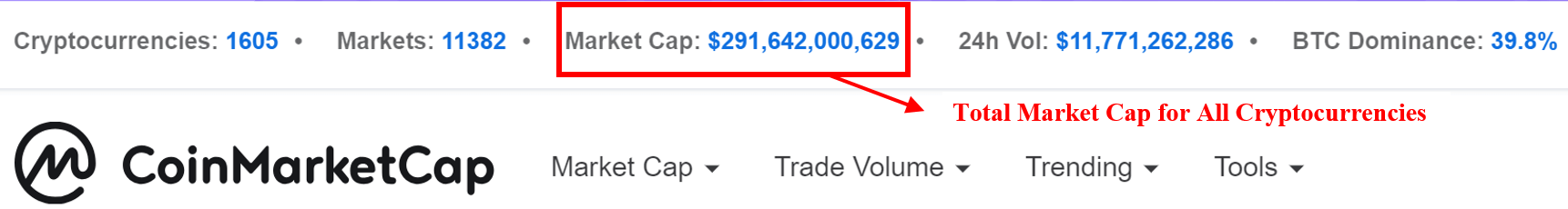

If you’re a frequent visitor to CoinMarketCap or any crytocurrency pricing platform, then you’d probably come across the total market capitalization for the entire cryptocurrency market. Here’s what you’ll see when you visit CoinMarketCap:

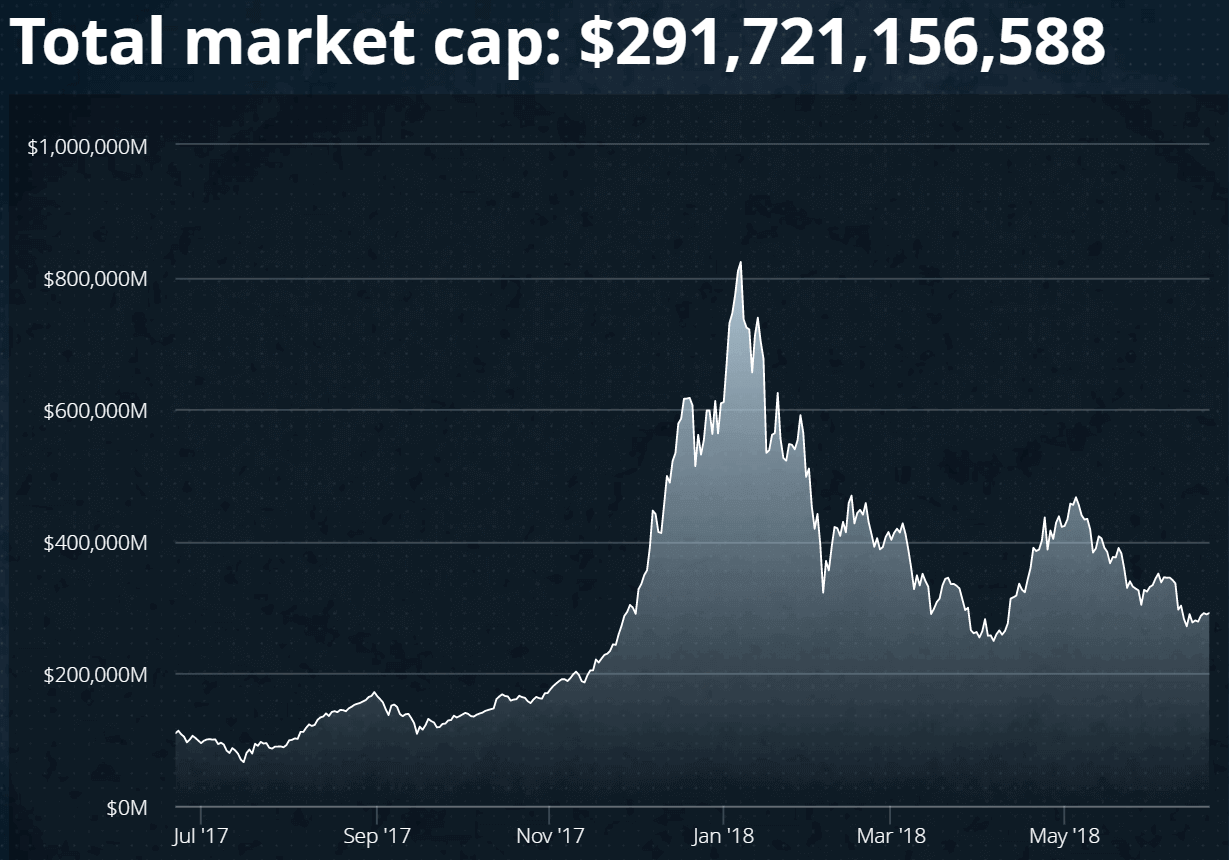

Total market cap is an indicator of the value of the entire cryptocurrency market. It is the sum of the market cap of all coins that are in existence in the cryptocurrency space. There are a total of 1,605 coins and tokens currently existing, and total market cap measures the size of the entire market. This makes it much easier for us to identify the growth and strength of the cryptocurrency market at any point of time. Here’s a graph that shows just that:

Currently, the total market cap of the entire crypto industry stands at USD $291 million, which is a far cry from its previous high of over $800 million at the start of 2018! As you can see, we can easily track the growth of the entire cryptocurrency market as a whole using this metric.

(Read also: 4 Reasons Why Now is the Best Time for You to Invest in Cryptocurrencies)

Importance of Market Cap

Financial theory suggests that the bigger the company, or cryptocurrency in this case, the slower the growth rate of that Cryptocurrency and the lesser risk there'll be. This is logical if we compare between Bitcoin – which is the first and largest Cryptocurrency – and a newly issued ICO token. The newly issued ICO token has a higher probability of increasing tremendously in price – double, triple or some cases more than 10X in price in a relatively short time! – as compared to Bitcoin. However, the risks would be tremendous; there's an equally high probability of the newly issued coin to fail since it is extremely new and hasn't stood the test of time. In the case of Bitcoin, there are much lower risks since it has been tes¬ted and proven since its creation way back in 2008!

Additionally, lower market cap coins tend to be heavily manipulated by traders and whales (term for big investors). It’s very easy for those with deep pockets to manipulate lower cap coins since the lack of trading volume allows prices to fluctuate wildly whenever they engage in trading. Since there’s basically little to no regulation in the cryptocurrency space, market manipulation is rife. It is much harder (though not impossible) to manipulate a larger market cap coin such as Bitcoin due to its relatively higher value and trading volume. You must trade huge amounts of Bitcoins to be able to move a market, which seems unlikely.

(See also: Guide To Crypto Technical Analysis: Introduction to Technical Indicators)

Should I Look at Current Price or Market Cap?

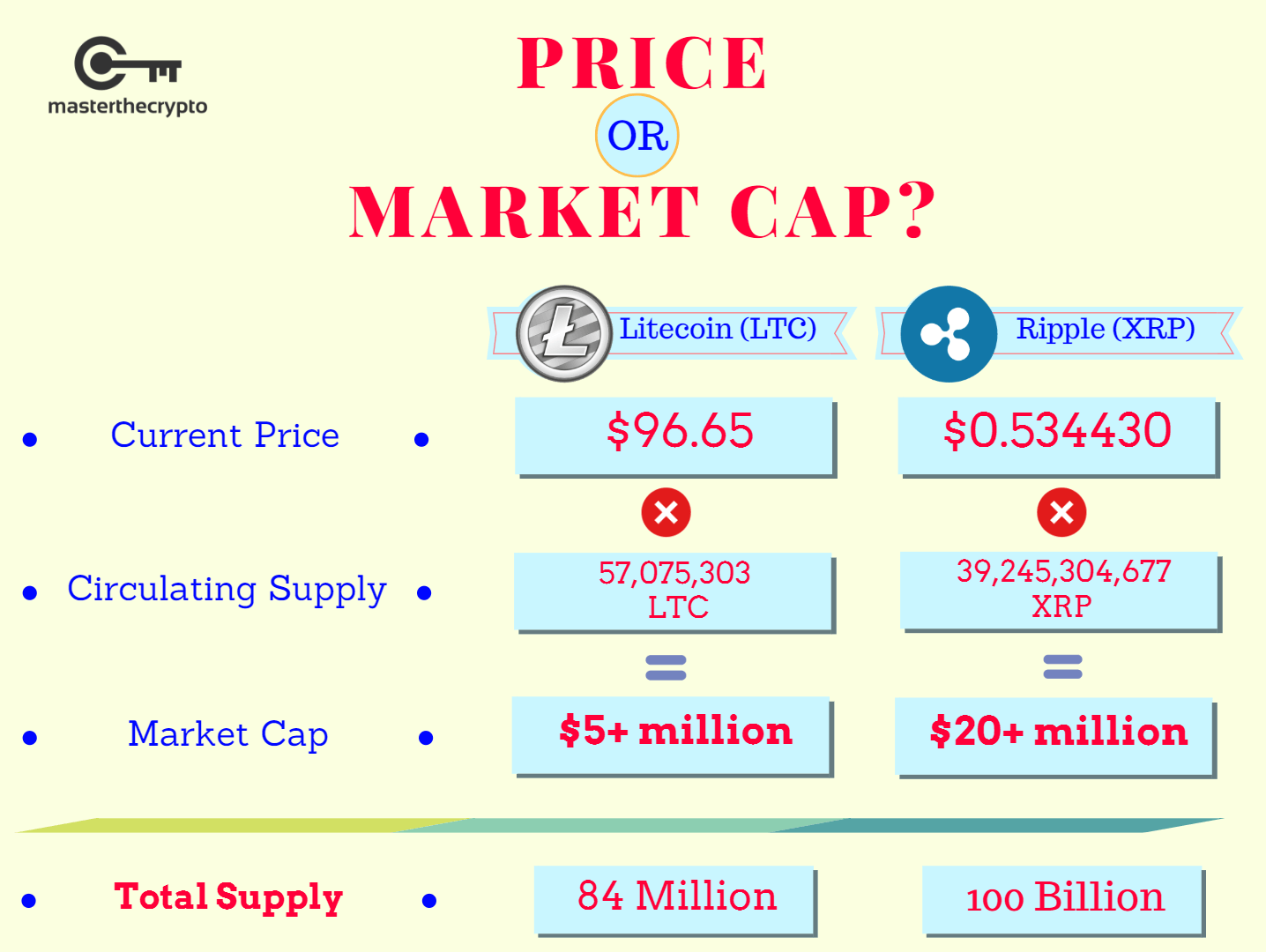

There’s a tendency to look at coins’ prices and associate a value to it purely based on its current price. For instance, whenever we see a coin that is priced at $0.10 or $0.05, we immediately associate that coin as being ‘cheap’ and would opine that there’s a high possibility that it is going to double, triple or even increase its value by a factor of 10. However, this is a major mistake since there is another equally important factor to consider when assessing the value of a coin: Circulating Supply. Let’s look at a comparison of Litecoin (LTC) and Ripple (XRP) to understand this confusion:

As you can see, Ripple is priced at 53 cents, which is a fraction of Litecoin’s price of $96. Anyone looking at both coins just by their price would misinterpret Ripple as the coin which has a better shot of multiplying its value much higher than Litecoin can, since it looks to be much ‘cheaper’. In their minds, its much easier for Ripple to double in value to $1+ than Litecoin to double. However, the reality is that there’s a much higher probability of Litecoin increasing in value far more than Ripple. This is because the circulating supply of Litecoin is only 57 million, far lower than Ripple’s current supply of 39 billion! This puts Litecoin at a lower market cap of $5 million compared to Ripple’s $20 million. In order to reach Ripple’s market cap, Litecoin must be priced at 4 times it current value, which is approximately $400.

Therefore, it is important to look at market cap rather than coin price just on its own!

Additionally, it is also important to consider that the total supply of Ripple is 100 billion, meaning that there’s over 40 billion XRP still unreleased. Economic theory states that a higher supply of anything leads to a lower price (assuming demand is constant). This is because the value of the coin – represented by market cap – is distributed to additional coins, which will drive prices lower.

(Read also: Guide to Blockchain Protocols: Comparison of Major Protocol Coins)

Is Market Cap All I Need?

Looking at any metric or indicator in isolation will not give you the big picture. In the case of market cap, it is generally an indicator of the size or value of the coin. Investing in any cryptocurrency just looking at one isolated metric would be dangerous since there are lots of other factors that you have to consider when making an investment decision. Though valuing a cryptocurrency can be extremely difficult, there are some indicators or characteristics that you can look at to have a greater overview of the particular coin. Here’s a checklist that can help you understand what to look out for when assessing any coin.

(You might also be interested in: Crypto Beginners Guide: 5 Things Crypto Newbies Should Know)

Beneficial Resources To Get You Started

If you're starting your journey into the complex world of cryptocurrencies, here's a list of useful resources and guides that will get you on your way:

Trading & Exchange

- Crypto Guide 101: Choosing The Best Cryptocurrency Exchange

- Guide to Bittrex Exchange: How to Trade on Bittrex

- Guide to Binance Exchange: How to Open Binance Account and What You Should Know

- Guide to Etherdelta Exchange: How to Trade on Etherdelta

- Guide To Cryptocurrency Trading Basics: Introduction to Crypto Technical Analysis

- Cryptocurrency Trading: Understanding Cryptocurrency Trading Pairs & How it Works

- Crypto Trading Guide: 4 Common Pitfalls Every Crypto Trader Will Experience

Wallets

- Guide to Cryptocurrency Wallets: Why Do You Need Wallets?

- Guide to Cryptocurrency Wallets: Opening a Bitcoin Wallet

- Guide to Cryptocurrency Wallets: Opening a MyEtherWallet (MEW)

Read also: Crypto Trading Guide: 4 Common Pitfalls Every Crypto Trader Will Experience and Guide To Cryptocurrency Trading Basics: Do Charts & Technical Analysis Really Work?

Get our exclusive e-book which will guide you on the step-by-step process to get started with making money via Cryptocurrency investments!

You can also join our Facebook group at Master The Crypto: Advanced Cryptocurrency Knowledge to ask any questions regarding cryptos!

I'm Aziz, a seasoned cryptocurrency trader who's really passionate about 2 things; #1) the awesome-revolutionary blockchain technology underlying crypto and #2) helping make bitcoin great ‘again'!