This is an analytical piece on how exchanges are manipulating the cryptocurrency market and what they stand to gain.

How Exchanges are Manipulating the Cryptocurrency Market

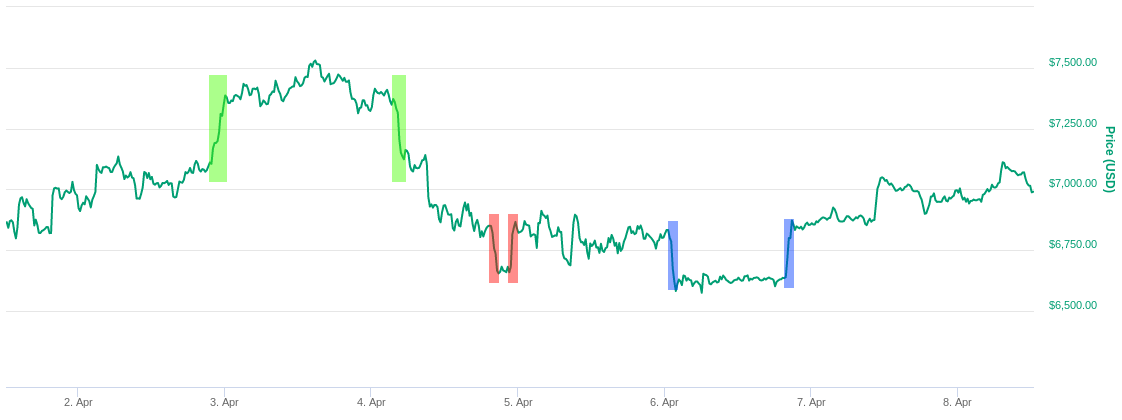

The current market seems to be largely driven not by organic buying and selling, but by exchange driven manipulation of the spot market to exploit the current dynamics of leverage trading. We just saw it again now as exchanges liquidated 3K long positions but you can see this pattern of clear manipulation over and over in the last few weeks:

What’s In It For The Exchanges?

We have seen several forces set an incentive for exchanges to do this:

- Consistently Declining Volume: This leads to lower total fee revenue for exchanges, and an incentive to manipulate the price in order to earn revenue through liquidations rather than trading fees.

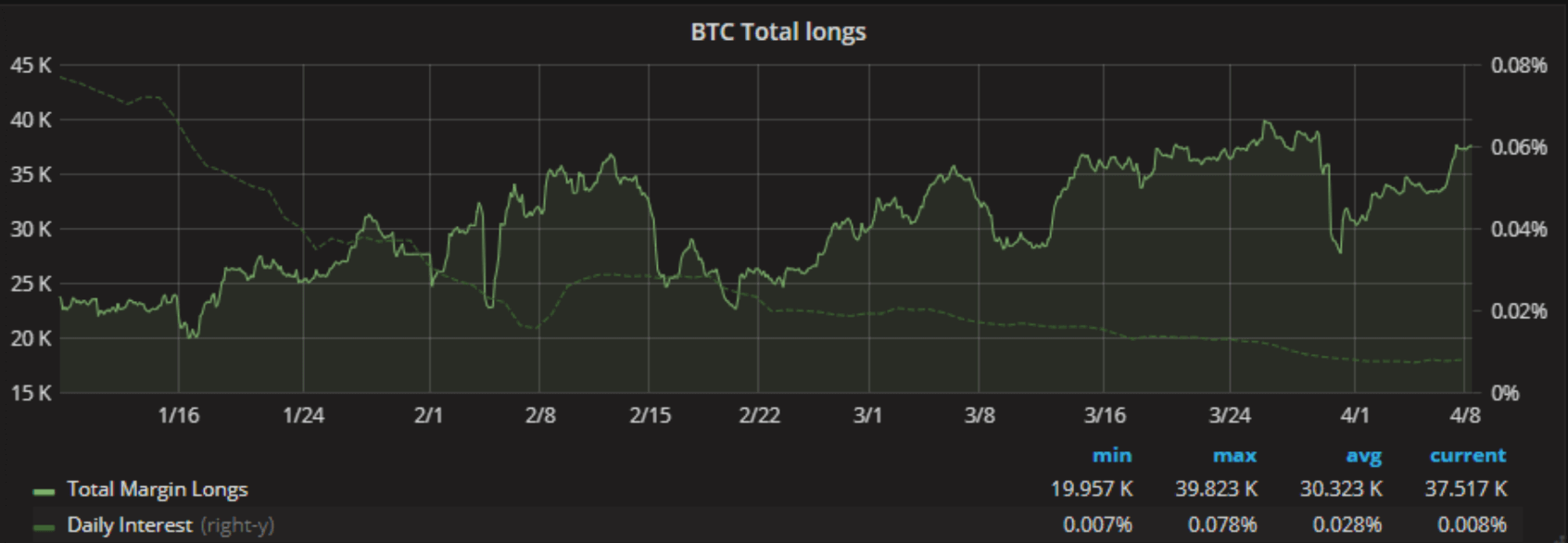

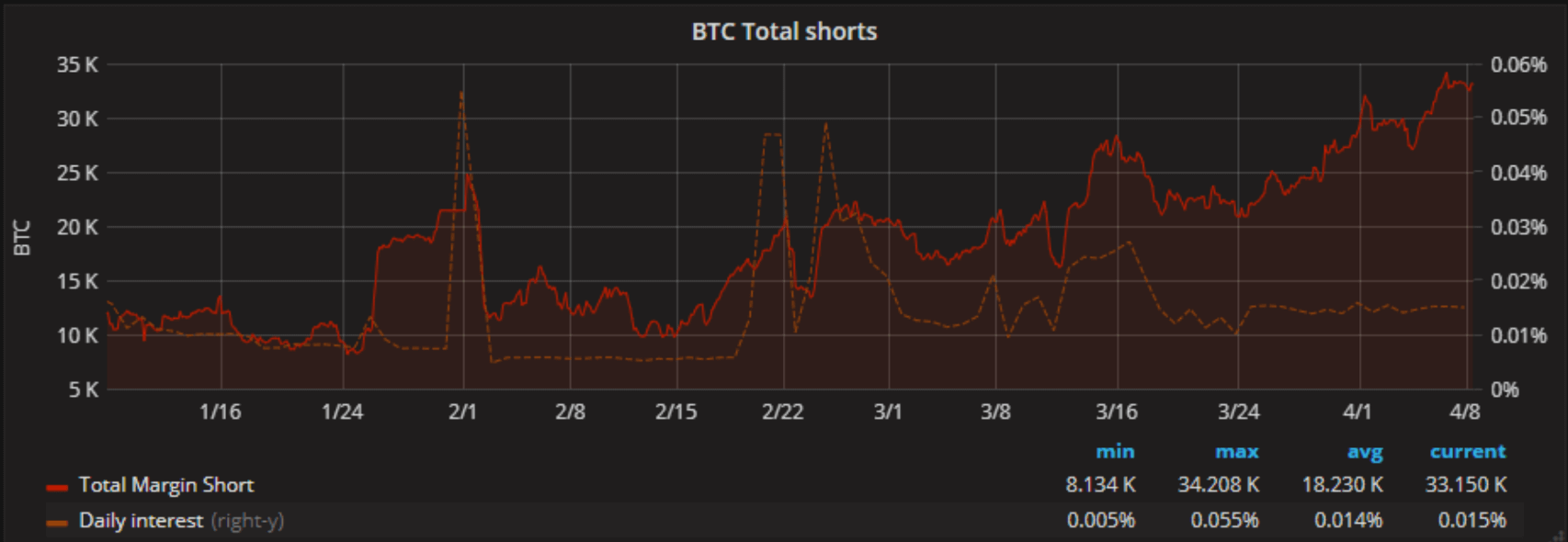

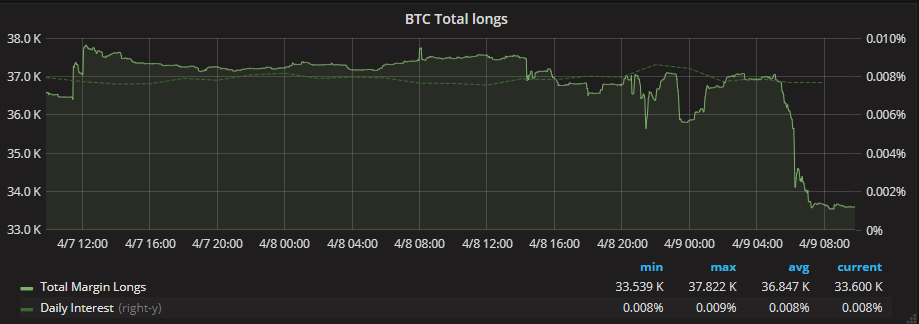

- Exponential Increase in Leveraged Positions: Both leveraged shorts and leveraged longs are at or near record levels. Shorts especially have gone from 8K outstanding in January to 33K right now, a whole tripling in outstanding positions.

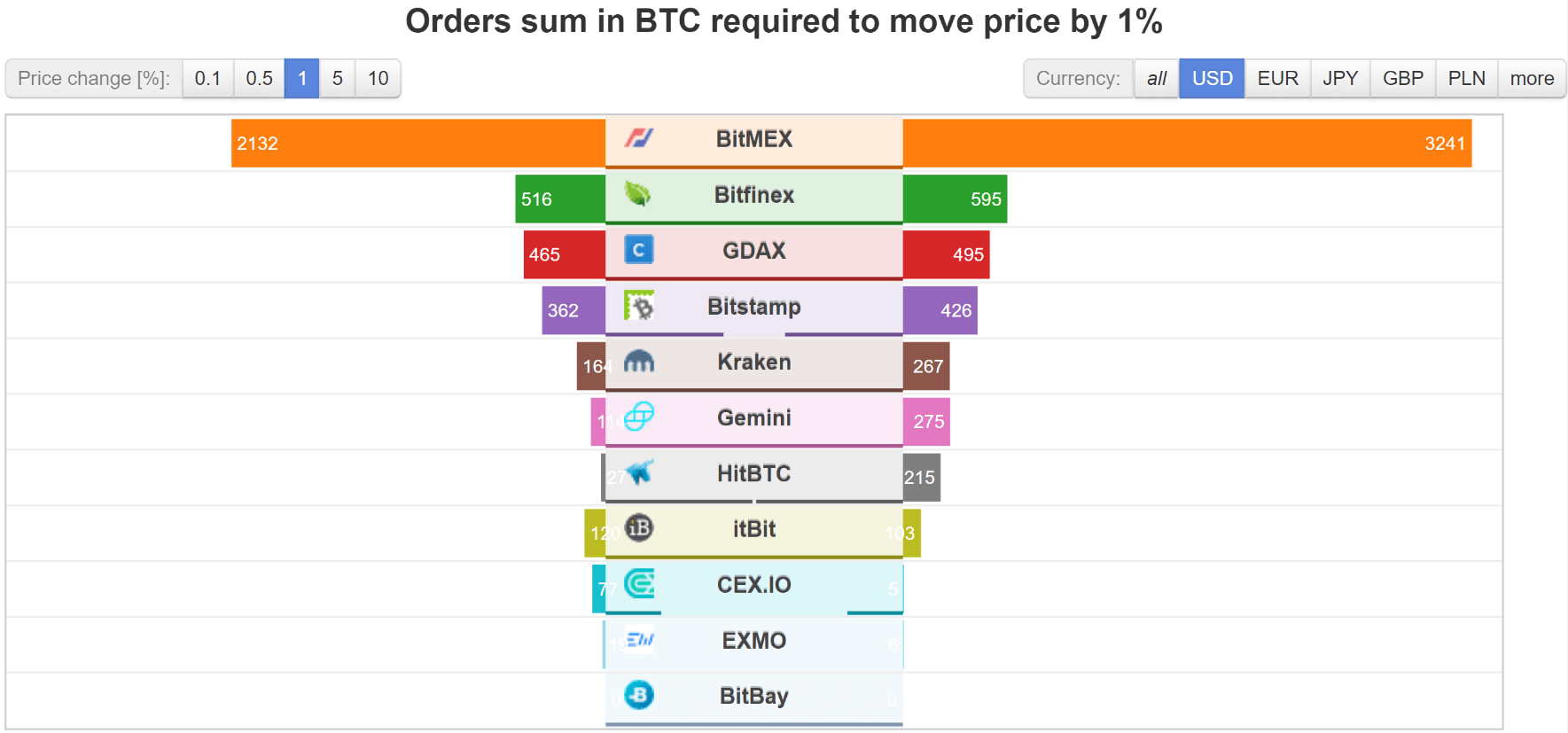

- Increasing Popularity of Derivatives & Fading of Spot Market: Anybody who has been checking the combined orderbook over the last few months has seen Bitmex completely take over the market, while GDAX, Bitfinex, Gemini and others see consistent declines.

There is an apparent, increased interest across the Internet on how derivatives work and anecdotally, more people are moving away from the ‘HODL’ meme and towards trading, taking high margin bets with a portion of their stack. (See more: Analyzing Cryptocurrency Risk: Existing Coins vs ICO)

Margin Trading is HUGE Business

Some exchanges like Gemini have reacted to all of this by increasing their trading fees by 400%. Meanwhile, Bitfinex specifically seems to be using its hefty weight to manipulate the price in order to capitalize on the record number of people using margin to bet.

Margin Trading is essentially borrowing money from lenders so that one can increase their buying power and invest in a larger amount of coins, or what they call “leverage.

Both longs and shorts are bets on the price moving up or down and they have a “liquidation price”, at which they get liquidated by the exchange. Essentially, the exchange gets the entire stack they bet with and extracts a high market fee multiplied by the leverage. Since the exchanges know the characteristics of the outstanding short/long positions, and since volume is low after these pumps or dumps leading to sideways drift, they can essentially engineer movements in price that create income in terms of liquidations. When there are lots of overleveraged shorts, an exchange can pump the price with bots briefly and collect the short position. It is similar to longs but in reverse, a quick burst of selling pressure.

(Read also: Guide on Identifying Scam Coins)

Evidence of Manipulation

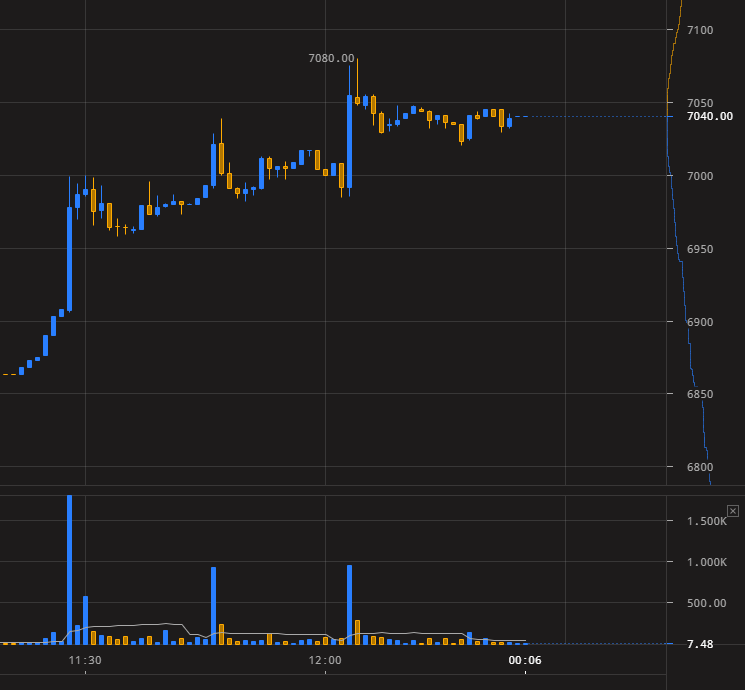

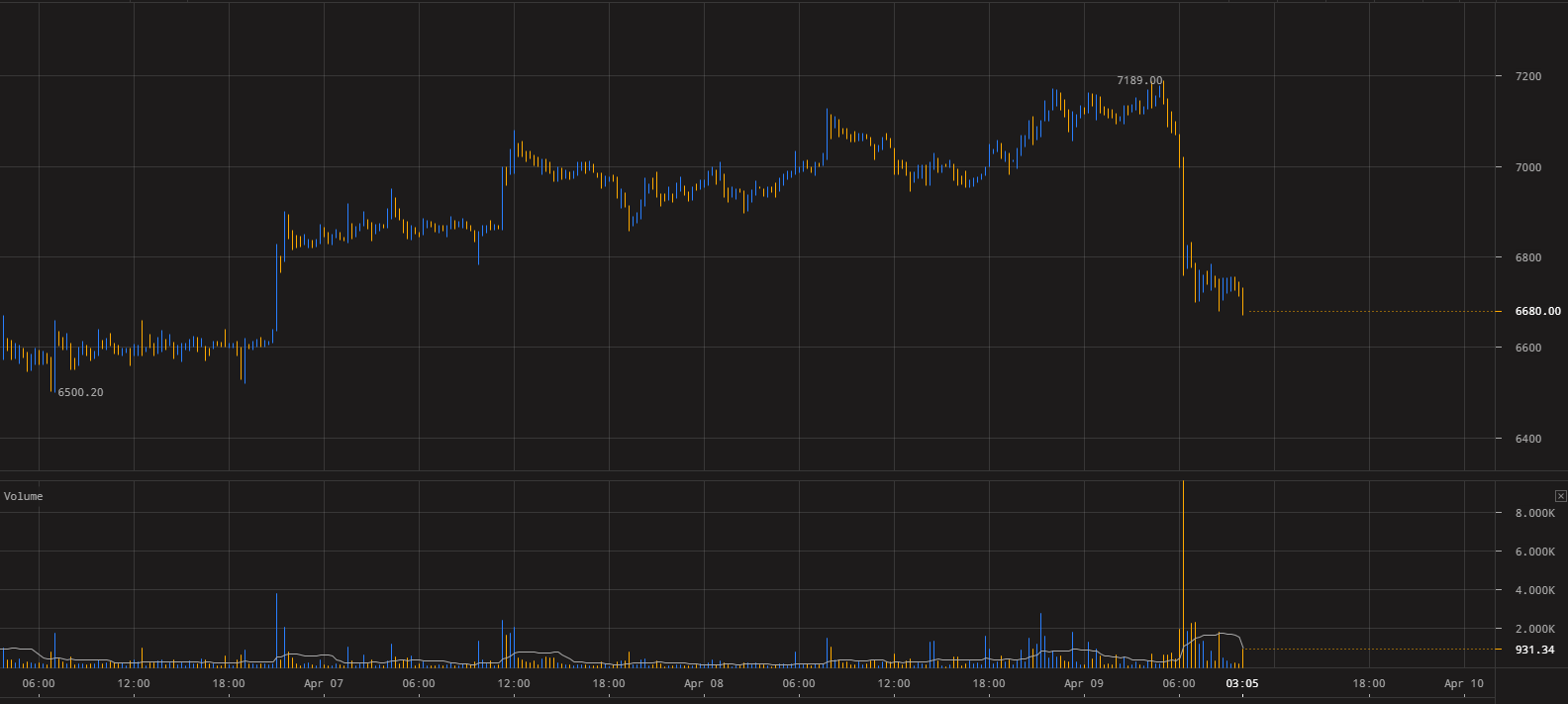

You can see this in the most recent pumps too on Bitfinex, where 1K buy orders appear out of nowhere after long sideways movement only to be followed by either sideways movement or slow bleed on pathetic volume:

Take a look at the most recent pump up to $7,000 (BTC), it instantanously liquidated about 700 short positions:

Now, this last dump was a laddered 12.5K sell order on Bitfinex that liquidated around 3K long contracts:

Bitfinex tends to be where the big money traders move (their minimum deposit is 10K). Therefore, even if each long position was only 0.5 BTC on average, they would stand to make a ton of money. If you look at the BitmexRekt twitter feed that shows a running list of Bitmex liquidations with humorous commentary, you will see many positions above $1 million dollars being liquidated during these moves.

This is what all the “Bart” formations we have seen stem from. It’s not George Soros pumping Bitcoin for fun and giggles, nor is it the nebulous “whales”. They have no incentive to try and pull off pump and dumps (P&Ds) now that it only leads to either sideways movement or decline after the pump. A PnD only works if the delta between the top of the pump endpoint and dump initiation point is positive, while at the moment, it seems to be followed by sideways movement.

Delta is a indicator used in derivatives trading to show the relation between the price of certain derivatives and the price of its underlying security.

Those who do want to bet on further upward movements seem to be doing it off the spot market, using margin with futures and perpetuity swaps on Bitmex. This makes the low volume spot market ripe for manipulation, exchanges like Bitfinex and Bitmex have every incentive right now to manipulate the price.

Spot market refers to the trading and prices you see in any exchange. For instance, if Bitcoin is trading at $10,000 on Exchange ABC, it’s spot price is $10,000.

(Read also: How Will Bitcoin Futures Affect Bitcoin Prices? Here’s What History Says)

Don't Be Pulled Into The Abyss

Looking back, it seems almost inevitable that this would have happened, that traders would try to replicate the gains they saw by buying and selling on the spot market a few months ago by using increased leverage and derivatives. In December and January, there were days where your holdings would increase by at least 20% no matter what you bought. Once you experience those 20% daily gains you don't want to go back to a market where it slowly bleeds down a few percent every week, so people jumped in on high leverage short positions to multiply their profit on those single percent moves down.

Essentially, many were greedy and were prepared to “double-down” on their bets

For the small-time investor there really isn't much you can do to stop this. This is what being part of an unregulated market means, it means that things like wash trading and long/short liquidation hunting is allowed. (Read more: Crypto ICO vs. Stock IPO: What’s the Difference?)

Wash Trading is a manipulative practice by exchanges – which are mostly unregulated – of buying and selling cryptocurrencies simultaneously to create artificial and misleading signals within the markets

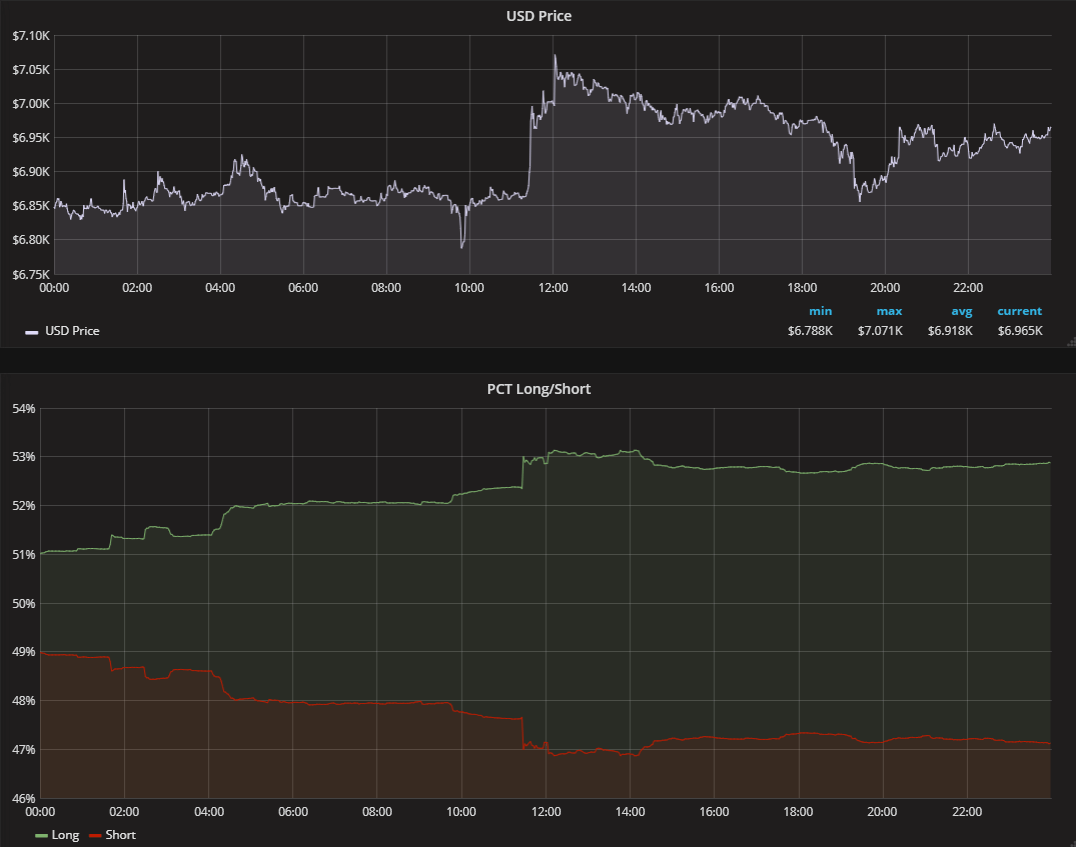

All you can really do if you're a trader is look at the current ratio of longs vs shorts on Bitfinex and be aware that once short contracts become too high, it’s possible that an exchange may pump the price to profit from it. Alternatively, if the longs become too dominant, we may see a dump.

Beneficial Resources To Get You Started

If you're starting your journey into the complex world of cryptocurrencies, here's a list of useful resources and guides that will get you on your way:

Trading & Exchange

- Crypto Guide 101: Choosing The Best Cryptocurrency Exchange

- Guide to Bittrex Exchange: How to Trade on Bittrex

- Guide to Binance Exchange: How to Open Binance Account and What You Should Know

- Guide to Etherdelta Exchange: How to Trade on Etherdelta

- Guide To Cryptocurrency Trading Basics: Introduction to Crypto Technical Analysis

- Cryptocurrency Trading: Understanding Cryptocurrency Trading Pairs & How it Works

- Crypto Trading Guide: 4 Common Pitfalls Every Crypto Trader Will Experience

Wallets

- Guide to Cryptocurrency Wallets: Why Do You Need Wallets?

- Guide to Cryptocurrency Wallets: Opening a Bitcoin Wallet

- Guide to Cryptocurrency Wallets: Opening a MyEtherWallet (MEW)

Read also: Guide on Privacy Coins: Comparison of Anonymous Cryptocurrencies and Why Ethereum is Looking Fundamentally Strong in This Bear Market

Get our exclusive e-book which will guide you on the step-by-step process to get started with making money via Cryptocurrency investments!

You can also join our Facebook group at Master The Crypto: Advanced Cryptocurrency Knowledge to ask any questions regarding cryptos!