This article explores the breakdown of cryptocurrency market into 12 major cryptocurrency categories for easy classification.

There are currently close to 1,600 different coins and tokens in the cryptocurrency world, each with their own applications and solving a particular problem. With so many cryptocurrencies in the ecosystem and more expected to be created, we’ve decided to categorize them into 12 major markets. In order to effectively classify these coins, we’ve decided to look at the Top 100 cryptocurrencies since they would be a close representation of the overall market. Which markets do you think will play the biggest role in the coming year?

In order for you to conveniently assess for yourself, we’ve gone all out to analyze all coins in the Top 100. Here is a complete overview of all coins in an excel sheet that together with their name, market, transactions per second (TPS), risk profile, time since launch (negative numbers indicate that they are launching that many months in the future) and market capitalization.

Breakdown of Top 100 Coins (Excel Sheet Format)

You can also sort the data by all of these fields. Coins highlighted in bold are the strongest contenders in their market, either due to having the best technology or having great potential (due to their relatively smaller market cap but superior technology). (Read also: Guide to Blockchain Protocols: Comparison of Major Protocol Coins)

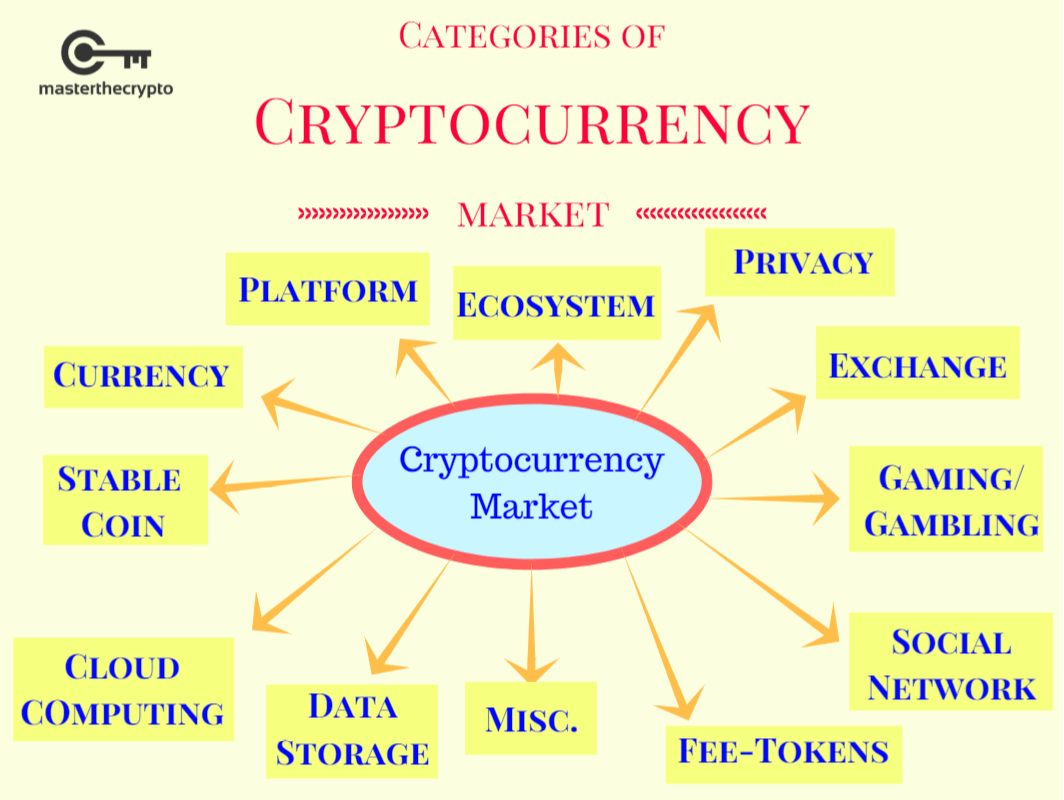

Category of Cryptocurrencies

Here is the breakdown of the coins and tokens based on their general markets:

The 12 markets are

- Currency: 13 coins

- Platform: 25 coins

- Ecosystem: 9 coins

- Privacy: 10 coins

- Currency Exchange: 8 coins

- Gaming & Gambling: 5 coins

- Social Network: 4 coins

- Fee-Based Token: 3 coins

- Decentralized Data Storage: 4 coins

- Cloud Computing: 3 coins

- Stable Coin: 2 coins

- Misc: 15 coins

(See also: Crypto Beginners Guide: 5 Things Crypto Newbies Should Know)

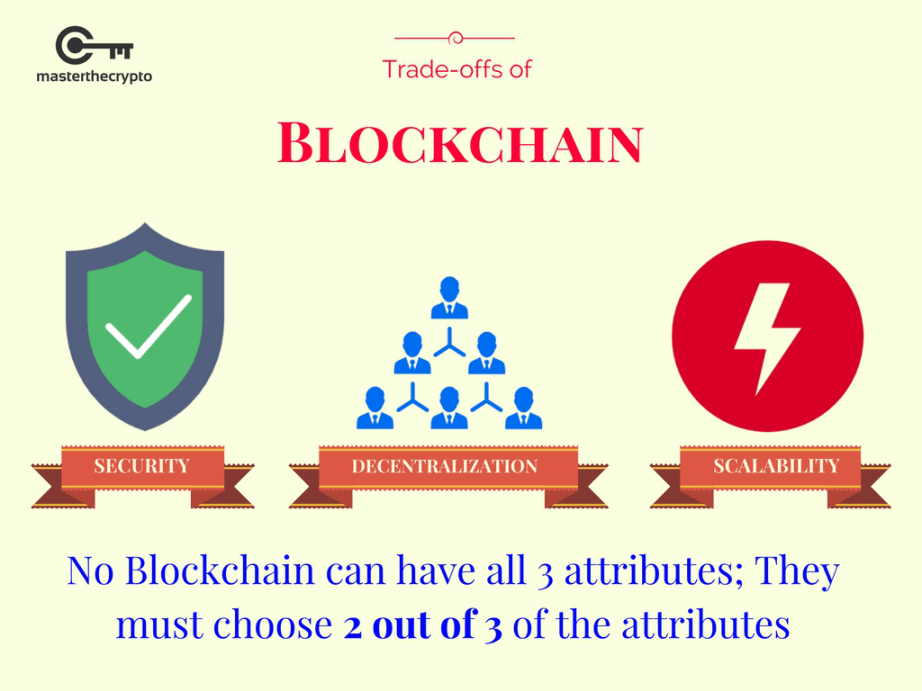

Public Enemy Number 1: Scalability

Before we dive into the individual markets, we need to take a look at the overall market and its biggest issue scalability first. Cryptocurrencies aim to be an open-sourced, decentralized currency that can be used globally. The goal is to replace all centralized, fiat currencies worldwide. The coin that can achieve that will be valued at several trillion dollars, which is proportionate to the size of the current fiat value. Not only that, the limited supply of most cryptocurrencies would result in greater appreciation if adoption and demand rise. (Read more: 4 Reasons Why Now is the Best Time for You to Invest in Cryptocurrencies)

The first and largest decentralized cryptocurrency, Bitcoin can only process 7 transactions per second (TPS). In order to replace all fiat, it would need to perform at least the capacity at which VISA operates. VISA processes around 3,000 transactions per second (TPS); up to 25,000 TPS during peak times and a maximum limit of 64,000 TPS.

This means that in order for cryptocurrencies to stand a chance of being a viable alternative, they must be able to perform at least several thousand TPS. However, it should also be stated that groundbreaking technology such as Blockchain should not be benchmarked against current technology to set a goal for its use, i.e. estimating the number of emails sent in 1990 based on the number of faxes sent wasn’t a good estimate.

For that reason, 10,000 TPS is the absolute baseline for a cryptocurrency that wants to replace fiat. This brings me to IOTA, a project that aims to connect all 80 billion IoT devices that are expected to exist by 2025. With constant communication from each other, IOTA could support 80 billion or more transactions per second. This is the benchmark that cryptocurrencies should be targeting for. However, it is also important for cryptocurrencies to constantly evolve and make the right tradeoffs. In the pursuit of scalability, security and decentralization would be compromised. Therefore, it needs to be seen, which of these technologies can prove itself in solving the scalability issue whilst retaining the initial qualities that cryptocurrencies were intended for.

With its Lightning network recently launched, Bitcoin is realistically looking at 50,000 TPS in the very near future. Other notable cryptocurrencies besides IOTA and Bitcoin includes:

- Nano, with 7,000 TPS already tested

- Dash with several billion TPS possible with Masternodes

- Neo, LISK and RHOC with 100,000 TPS by 2020

- Ripple with 50,000 TPS

- Ethereum with 10,000 TPS with Sharding.

We will explore each of the 12 cryptocurrency markets in the next articles. Do stay tuned!

(See more: Bitcoin vs Alt Coins Returns: Comparison of Gains Between Bitcoin & Altcoins Investing)

Beneficial Resources To Get You Started

If you're starting your journey into the complex world of cryptocurrencies, here's a list of useful resources and guides that will get you on your way:

Trading & Exchange

- Crypto Guide 101: Choosing The Best Cryptocurrency Exchange

- Guide to Bittrex Exchange: How to Trade on Bittrex

- Guide to Binance Exchange: How to Open Binance Account and What You Should Know

- Guide to Etherdelta Exchange: How to Trade on Etherdelta

- Guide To Cryptocurrency Trading Basics: Introduction to Crypto Technical Analysis

- Cryptocurrency Trading: Understanding Cryptocurrency Trading Pairs & How it Works

- Crypto Trading Guide: 4 Common Pitfalls Every Crypto Trader Will Experience

Wallets

- Guide to Cryptocurrency Wallets: Why Do You Need Wallets?

- Guide to Cryptocurrency Wallets: Opening a Bitcoin Wallet

- Guide to Cryptocurrency Wallets: Opening a MyEtherWallet (MEW)

Read also: Guide to Margin Trading & Derivatives: Are Cryptocurrency Exchanges Really Manipulating? and Guide To Cryptocurrency Trading Basics: Do Charts & Technical Analysis Really Work?

Get our exclusive e-book which will guide you on the step-by-step process to get started with making money via Cryptocurrency investments!

You can also join our Facebook group at Master The Crypto: Advanced Cryptocurrency Knowledge to ask any questions regarding cryptos!

ounder Institute Mentor, Blockchain-Evangelist