This article will guide you through an ICO investing strategy that will open many opportunities for you in making money off ICOs.

Investing in Initial Coin Offerings (ICO) is a new phenomenon in the cryptocurrency world that has been making many people very rich. Just imagine investing just $100 in Bitcoin (BTC) – the first and largest cryptocurrency – back in 2011 when it costs $0.30 for a single Bitcoin. You would be worth more than $3.5 million today.

How about investing in Ether (ETH) at the start of 2017 when it was worth less than $10? These spectacular gains would have made you extremely rich, and this possibility is what excites many entering into the cryptocurrency world. ICOs provides you with the opportunity to invest in the project at its earliest stage, and if they are successful in executing their vision, then investors will stand to reap the potentially tremendous returns.

(See more: Understanding Cryptocurrencies: Game of Thrones Edition)

What is an ICO?

An Initial Coin Offering (ICO) refers to a process of raising funds by cryptocurrency projects.

“It’s like penny stocks but with less regulation.”

– Jeff Garzik

Investors exchange the base currency of Bitcoin (BTC) or Ethereum (ETH) for a stake in the initial stages of the project. The project will thereafter issue their native tokens to investors in return for the base currencies. This is similar to an Initial Public Offering (IPO), where stocks of companies will be offered to the public. Here’s an article outlining the differences between an ICO and an IPO.

A report from Mangrove Capital Partners found that the average returns of over 200 ICOs are at an astonishing 1,320%. Compare that to the average stock market returns of 7% – 10% annually, it is no wonder many are jumping into ICOs with fervour.

How Do I Get Started?

Here are some factors to look out for when investing in an ICO to potentially make lots of money.

Promising ICOs

You should look for projects that have good long-term fundamentals. Assessing a project based on its vision, the problems it is trying to solve and the quality of its developing team is vital in understanding whether the project has great prospects. Good projects will tend to achieve their objectives and deliverables, which will, in turn, be reflected in an appreciation of their token’s price over the long-term. (See more: Coins, Tokens & Altcoins: What’s the Difference?)

Bonus Offerings

Most ICO’s have a bonus system to reward early investors. The bonuses can range from between 10% – 100% depending on certain ICOs, where early investors will receive additional tokens for their contributions. Some ICO’s even have a presale stage (or pre-ICO) that allows the public to invest before the ICO dates. Usually, investments in the pre-ICO stage is higher than on the actual ICO period.

Low Hardcap Coins

Hardcap refers to the maximum amount raised by the project, usually in denominated in USD or ETH value. So, if a project wants to raise a maximum of USD $30 million, that would be the project’s hardcap. A good project with a low hardcap amount often tends to be sold out fast, often in minutes!

Once the ICO tokens are released on an exchange, prices would tend to shoot up in value – often in multiples – as there will be a huge demand stemming from those that were not able to invest during the ICO stage. A trait of popular ICOs is that they would have a whitelisting period, where you must register yourself prior to the ICO period to book a slot for the actual ICO date.

Here’s a guide that will help you in your journey to investing in any ICO: Beginner's Guide to ICO Investing: How to Participate in ICOs.

Importance of Due Diligence

Before going all in on ICOs, investors must understand that investing in Cryptocurrencies is an extremely high-risk endeavour. ICOs have a particularly higher risk profile as most of them are only at the conceptualization stage; they often do not have a working protocol/product and hence, there's minimal indication that it is going to be a success or even viable in the long-term. Therefore, it is vital that thorough due diligence is undertaken.

Here's a guide to fundamental analysis for cryptocurrencies that can help you in your due diligence process.

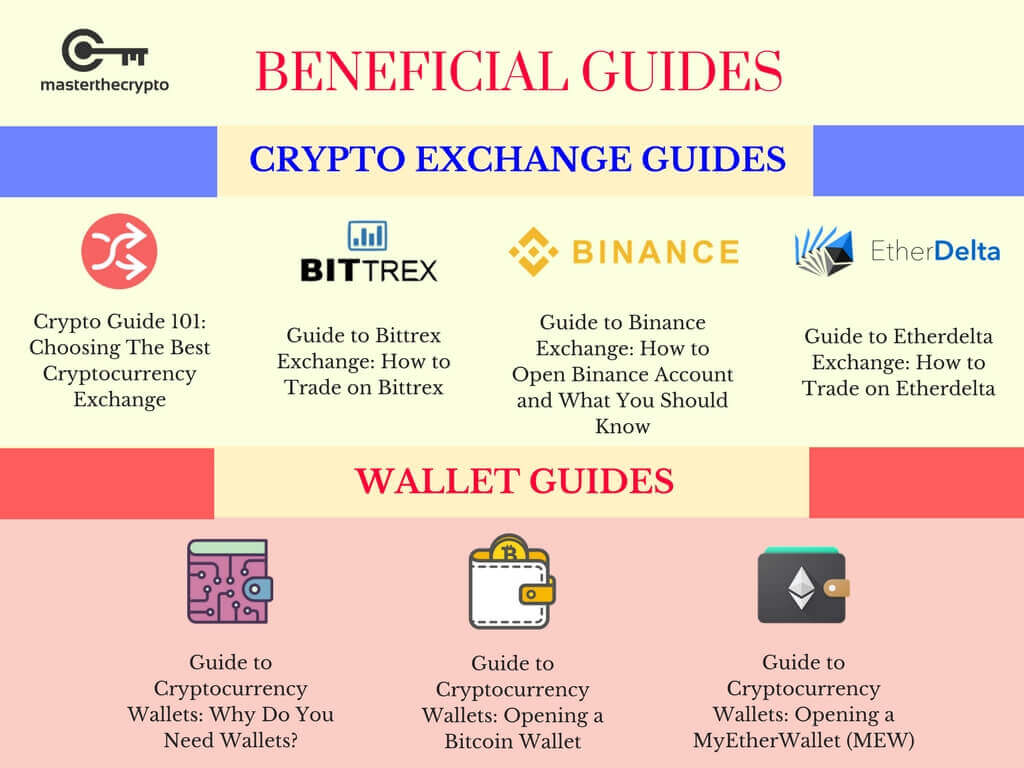

Beneficial Resources To Get You Started

If you're starting your journey into the complex world of cryptocurrencies, here's a list of useful resources and guides that will get you on your way:

Trading & Exchange

- Crypto Guide 101: Choosing The Best Cryptocurrency Exchange

- Guide to Bittrex Exchange: How to Trade on Bittrex

- Guide to Binance Exchange: How to Open Binance Account and What You Should Know

- Guide to Etherdelta Exchange: How to Trade on Etherdelta

- Guide To Cryptocurrency Trading Basics: Introduction to Crypto Technical Analysis

- Cryptocurrency Trading: Understanding Cryptocurrency Trading Pairs & How it Works

- Crypto Trading Guide: 4 Common Pitfalls Every Crypto Trader Will Experience

Wallets

- Guide to Cryptocurrency Wallets: Why Do You Need Wallets?

- Guide to Cryptocurrency Wallets: Opening a Bitcoin Wallet

- Guide to Cryptocurrency Wallets: Opening a MyEtherWallet (MEW)

Read also: Guide on Privacy Coins: Comparison of Anonymous Cryptocurrencies and Guide To Cryptocurrency Trading Basics: Do Charts & Technical Analysis Really Work?

This represents the writer’s personal opinions and does not – in any way- constitute a recommendation of an investment or financial advice. Please assume caution when investing in cryptocurrencies and do so at your own risk, as it is extremely volatile and you can lose your money.

Get our exclusive e-book which will guide you on the step-by-step process to get started with making money via Cryptocurrency investments!

You can also join our Facebook group at Master The Crypto: Advanced Cryptocurrency Knowledge to ask any questions regarding cryptos!

I'm Aziz, a seasoned cryptocurrency trader who's really passionate about 2 things; #1) the awesome-revolutionary blockchain technology underlying crypto and #2) helping make bitcoin great ‘again'!