This article takes at cryptocurrency risk, through the lens of existing coins vs ICO. Do they have the same level of risks?

Cryptocurrencies are one of the most — if not the most — volatile asset class there is; you can make loads of money or lose everything. While for many the possibility of generating spectacular returns is the key attraction of crypto, are the risks really worth the potential rewards?

In an effort to answer this question, this article explores the risk-reward profiles of a couple of different types of cryptographic assets. The first being Initial Coin Offerings (ICOs) and the second being existing coins and tokens. (Read also: Crypto Beginners Guide: 5 Things Crypto Newbies Should Know)

Initial Coin Offerings (ICO)

An ICO refers to the process of raising funds for early-stage crypto projects, in return for an issuance of a newly-created, native token. ICOs are an exciting category within the crypto sphere, with the potential to generate very high returns. A report from Mangrove Capital Partners, for example, found that the average returns across 200 surveyed ICOs in 2017 was an astonishing 1,320 percent. (See more: Bitcoin vs Alt Coins Returns: Comparison of Gains Between Bitcoin & Altcoins Investing)

Naturally, though, ICOs come with a higher risk profile than existing, tradeable coins in the market.

Just like how penny stocks are riskier when compared to the stocks of blue-chip (established) corporations

ICO's inherently possess a higher degree of risks since the majority of them, do not have a working protocol or product at the outset, with only a theoretical conceptualization of their project as manifested in their white paper. For investors, therefore, it is vital to understand that there exists a high statistical probability of failure in the crypto start-up world. There have been many cases of scam ICOs, and it is important to understand how to sieve them out.

Additionally, there is also the issue of the absence of regulatory oversight towards ICOs, which translates into the non-existence of consumer-protection laws in the crypto asset space. Regulators are monitoring closely the developments in the cryptocurrency world, and are in the midst of constructing laws to regulate cryptocurrencies.It's interesting to point out that ICOs are similar Initial Public Offerings (IPO) – its equivalent in the stock market – but with certain distinct differences.

(Read also: Beginner's Guide to ICO Investing: How to Participate in ICOs)

Existing Coins and Tokens

There are more than 1,500 coins and tokens currently being traded on exchanges. It's interesting to point out that there's a difference between cryptocurrency coins and tokens, which is explained here. Under the BNC General Taxonomy, we can see that all cryptographic assets can be segregated into different categories based on their applications and the range of use-cases they were intended for.

The risk profile of existing cryptographic assets is lower than that of ICOs for the simple reason that they have some history. Therefore, investors can track the progression of the projects and get a feel of its valuation, checking if they’ve met their deliverables and achieved the milestones set in their whitepapers. Time will tell if the technology and applications of a project are viable, and its price will be a reflection of that. Besides the apparent volatility risks, the operational risks of securing cryptographic assets safely is a major point of concern especially as many aren't really ‘tech-inclined’ when it comes to crypto, given the complexity of the technology. (See also: Guide to Common Crypto Terms)

In a nutshell, crypto assets are high-risk investments and the recent correction is a testament to that. The entire crypto market has decreased by more than 60% so far in 2018 from its December 2017 highs. However, looking beyond the short-term oscillations, there are some fundamental reasons as to why the volatility and risks appear as they do.

(See also: Evolution of Cryptocurrency: What is Cryptocurrency?)

Infant Technology

It has been well documented that the inception of revolutionary technologies — like the internet — often entails initial periods of volatility, due to the infancy of the technology and limited adoption. Blockchain, the technology underpinning Bitcoin and a majority of other cryptocurrencies, possess the potential to disrupt a number of industries and bring positive changes on a global scale, advancing the principles of transparency, efficiency and accountability.

The fact that Blockchain technology has been around for more than 10 years with no fundamental flaws, an exponentially growing list of applications, and a dynamic ecosystem that is constantly pushing the technological limits is a testament to its potential. (Read also: Guide to Forks: Everything You Need to Know About Forks, Hard Fork and Soft Fork)

Utility Leads to Adoption

In a bid to achieve widespread adoption, crypto projects must offer viable solutions to real-world problems and thus warrant their usage. This is reflected in the utility — or use-cases. Using Bitcoin as an example, its dominant utility as a peer-to-peer medium of exchange is that it allows users to circumvent excessive banking (or any third party) fees and significantly reduce transaction times (though in reality, Bitcoin is facing scalability issues). (Read more: Evolution of Cryptocurrency: Replacing Modern Cash)

In essence, Bitcoin allows users to engage in a global transfer of value at a fraction of the traditional cost and time. A greater rate of adoption will lead to higher Bitcoin prices, due to increasing demand. Having a strong utility is therefore vital in substantiating the value of cryptocurrencies, which will ultimately benefit long-term investors.

Importance of Due Diligence

It is interesting to note that a recent study found that the cryptocurrency market is mainly driven by investor sentiment, and this leads to high levels of volatility. In addition, the technical nature of cryptocurrencies makes it hard for many to understand them.

However, performing due diligence is a vital requirement in the investing process to ensure that one invests in cryptocurrencies that are fundamentally strong and possess long-term viability. Investing in good projects will significantly reduce your risk profile, assuming you’re in it for the long-term.

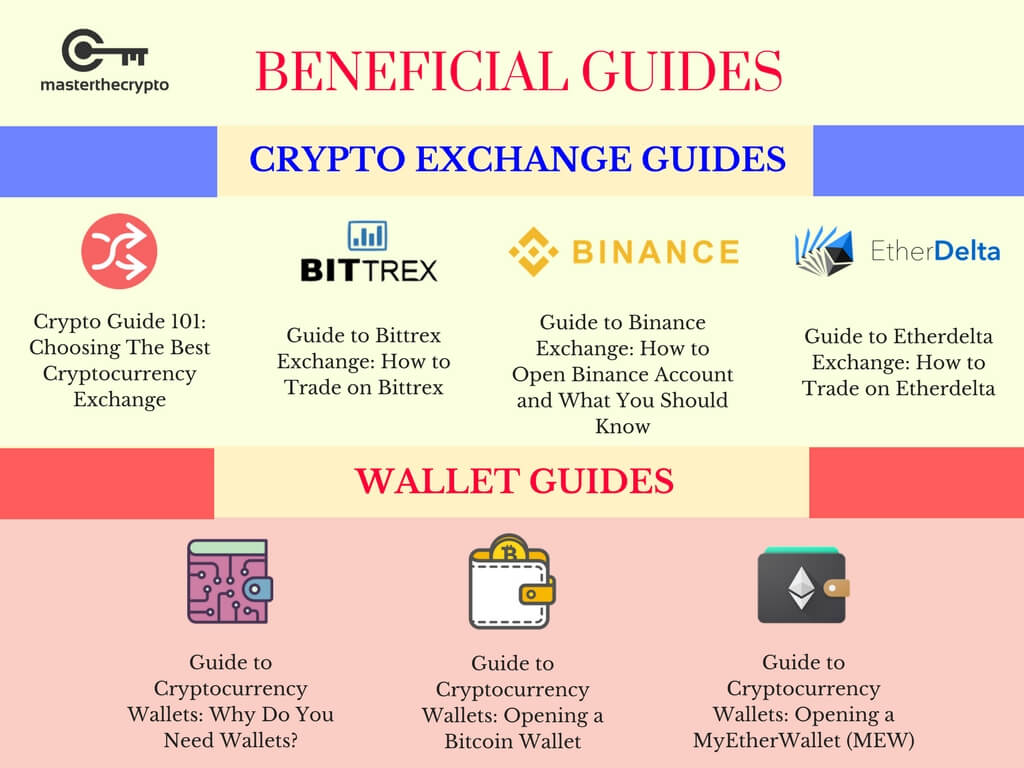

Beneficial Resources To Get You Started

If you're starting your journey into the complex world of cryptocurrencies, here's a list of useful resources and guides that will get you on your way:

Trading & Exchange

- Crypto Guide 101: Choosing The Best Cryptocurrency Exchange

- Guide to Bittrex Exchange: How to Trade on Bittrex

- Guide to Binance Exchange: How to Open Binance Account and What You Should Know

- Guide to Etherdelta Exchange: How to Trade on Etherdelta

- Cryptocurrency Trading: Understanding Cryptocurrency Trading Pairs & How it Works

Wallets

- Guide to Cryptocurrency Wallets: Why Do You Need Wallets?

- Guide to Cryptocurrency Wallets: Opening a Bitcoin Wallet

- Guide to Cryptocurrency Wallets: Opening a MyEtherWallet (MEW)

Read also: Cryptocurrency Accounting Guide: How Do I Calculate My Crypto Gains? and Guide To Cryptocurrency Trading Basics: Introduction to Crypto Technical Analysis

Get our exclusive e-book which will guide you on the step-by-step process to get started with making money via Cryptocurrency investments!

You can also join our Facebook group at Master The Crypto: Advanced Cryptocurrency Knowledge to ask any questions regarding cryptos!

I'm Aziz, a seasoned cryptocurrency trader who's really passionate about 2 things; #1) the awesome-revolutionary blockchain technology underlying crypto and #2) helping make bitcoin great ‘again'!