This article explains the basics of understanding Cryptocurrency trading pairs and how it works, which represents a key element in Cryptocurrency trading.

Delving into the crypto world is extremely intimidating, especially when you're dealing with a subject matter that is naturally complex. Not only do you have to deal with the complexities of understanding the tech behind cryptocurrencies, but you'd also have to deal with the difficulty in knowing the intricacies of trading cryptocurrencies. Like it or not, anyone who wants to enter the Crypto world MUST have a basic understanding of how to trade. Why? Because if you want to own cryptocurrencies, you must know how to buy or sell them in an exchange, what factors to look out for and how to manage your coins, amongst other things. (See more: 4 Reasons Why Now is the Best Time for You to Invest in Cryptocurrencies)

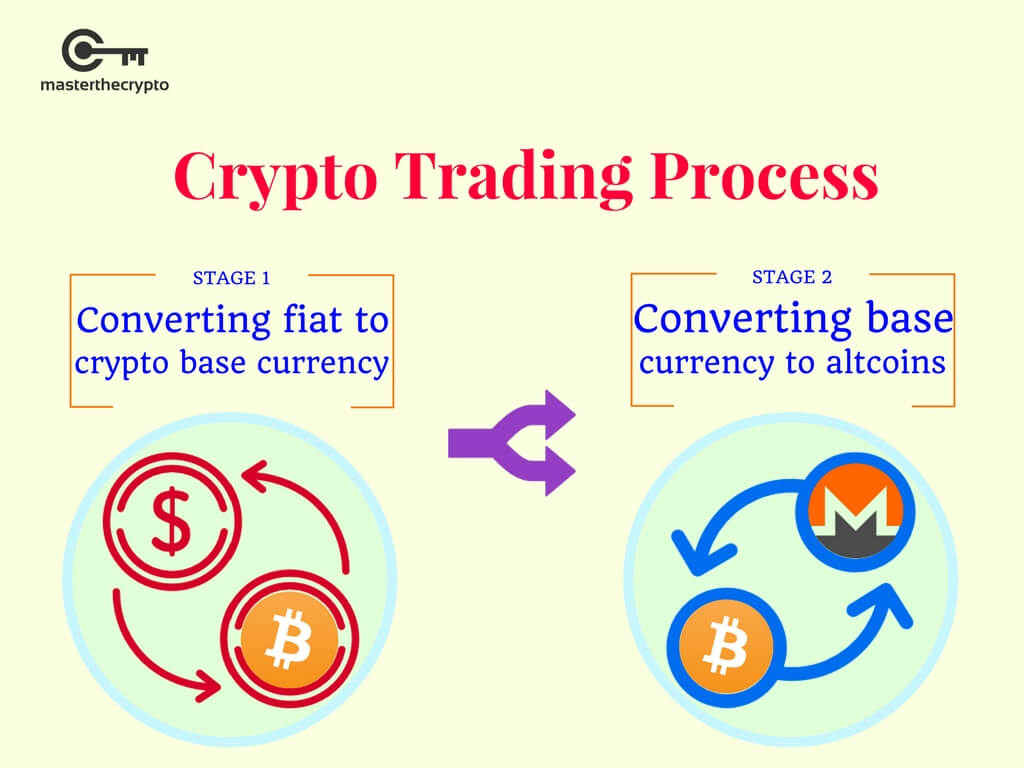

Before going into the specifics, it's important to understand the general overview of the Cryptocurrency trading process:

Stage 1

The first stage entails buying the base currency of the Cryptocurrency world, in the form of Bitcoin using your domestic currency. Here's a helpful guide: Crypto Guide 101: Choosing The Best Cryptocurrency Exchange.

A base currency is defined as the common currency against which all Cryptocurrencies are quoted in

There are more than 1,200 cryptocurrencies in existence, in which all of these coins can only be bought using Bitcoin and they cannot be bought using your domestic currency. That is why Bitcoin is considered the gateway to the crypto world and thus, a base currency for cryptos. This stage converts your fiat currency (paper currency) into the crypto base currency. (Read more: Coins, Tokens & Altcoins: What’s the Difference?)

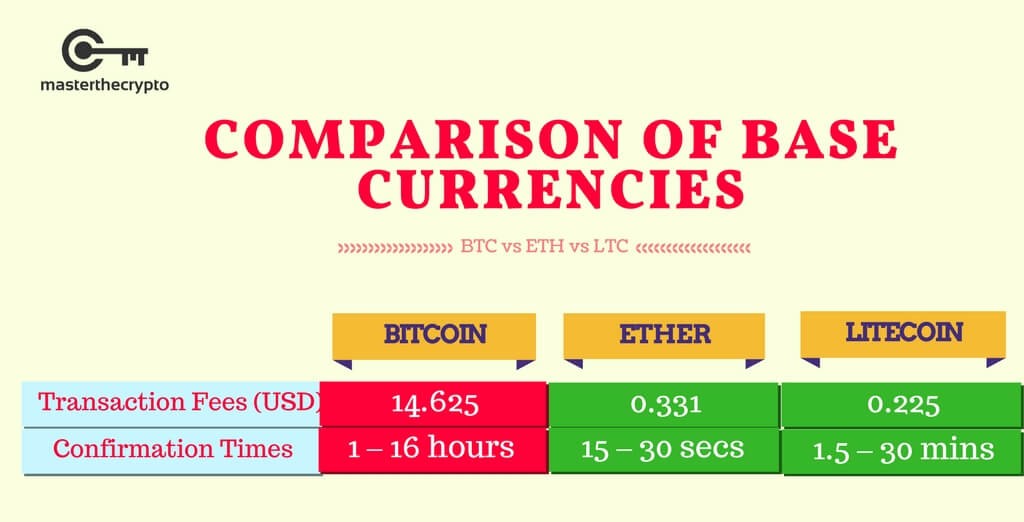

Some domestic exchanges allow you to buy Ethereum and Litecoin using your domestic currency. Therefore, ETH and LTC would also be considered as base currencies alongside Bitcoin. In fact, ETH and LTC are even more preferred as confirmation times are much faster and they are much cheaper to transfer.

Comparison of BTC vs ETH vs LTC (As of 1 January 2018)

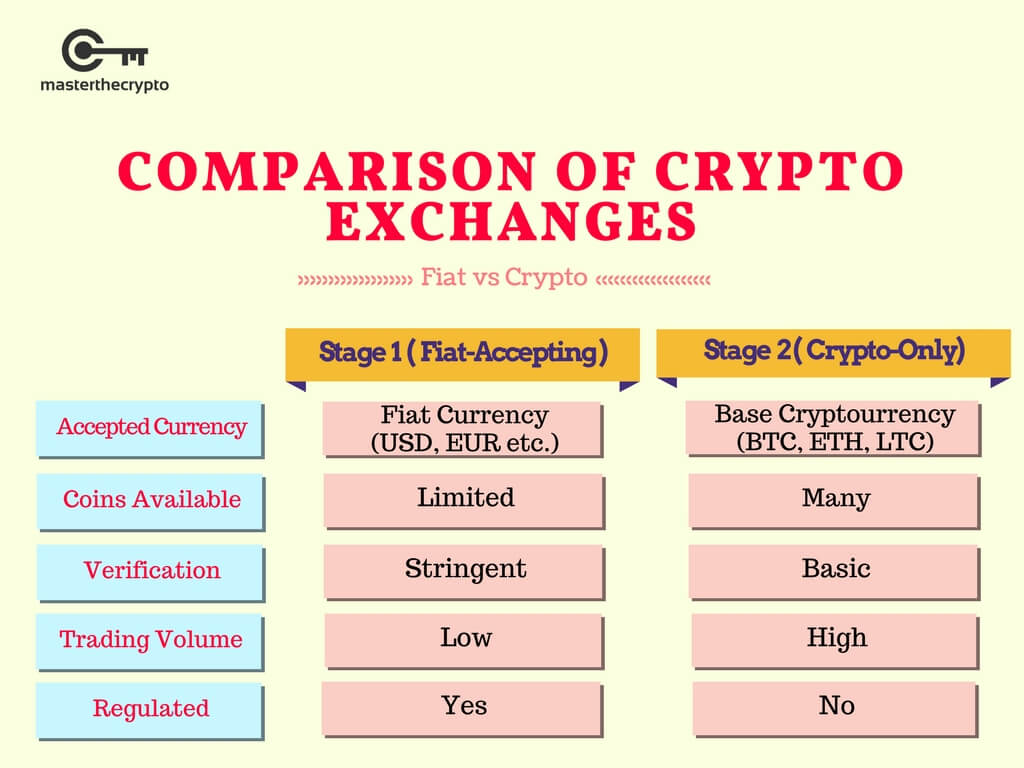

Stage 1 requires you to open a local crypto exchange that accepts your domestic currency (e.g. USD, CAD, GBP, EUR). More often than not, local cryptocurrency exchanges do not offer a wide variety of coins to trade, and that's the main reason for buying the base currencies.

If your only objective is to buy and hold a base currency of BTC, ETH of LTC, then Stage 1 is sufficient. If you want to buy any other coins besides those 3, then you would proceed to Stage 2. It should be noted that in both Stages, you shouldn't store your coins in an exchange but instead in a private wallet that you control, so as to secure your coins safely. Here's a Guide to Cryptocurrency Wallets: Why Do You Need Wallets?

Stage 2

Assuming that you're planning to buy other altcoins besides BTC, ETH or LTC, you must enter into Stage 2. This rate requires you to open a cryptocurrency exchange that only accepts Cryptocurrency deposits. Unlike the crypto exchange in Stage 1, the crypto exchange in Stage 2 DOES NOT accept fiat money or your domestic currency. You can only use the base currency that you've bought in Stage 1 – BTC, ETH or LTC – to buy any other altcoins. Here's the list of differences between a fiat-accepting exchange (Stage 1) and a Crypto-accepting exchange (Stage 2).

Understanding Cryptocurrency Trading Pairs

After understanding the cryptocurrency trading process, it's time to dive deeper into the mechanics of the cryptocurrency trading pairs and how it works.

Stage 1

In the first stage, the base currency of BTC, ETH, or LTC that you buy will be quoted in your domestic currency. This is straightforward as you will be aware of the value of coins you're buying with your domestic currency. For instance, if the current price of Bitcoin is USD $20,000 and you're planning to buy USD $1,000 worth of Bitcoin, you'd get 0.05 BTC for your USD $1,000. If the price of a Bitcoin goes up 50% to USD $30,000 each, then your BTC has also increased by 50%, thereby valuing your 0.05 BTC at a great USD $1,500. You would get a profit of USD $500 if you sold all your BTC and cashed-out your investment. (See more: Bitcoin vs Alt Coins Returns: Comparison of Gains Between Bitcoin & Altcoins Investing)

Stage 2

This is the more complicated step; understanding the trading pair ratio when buying altcoins using BTC (or ETH/LTC) as your base currency. Since you cannot buy altcoins directly from Stage 1 exchanges, the price of the altcoins is not quoted in your domestic currency. Here's an example:

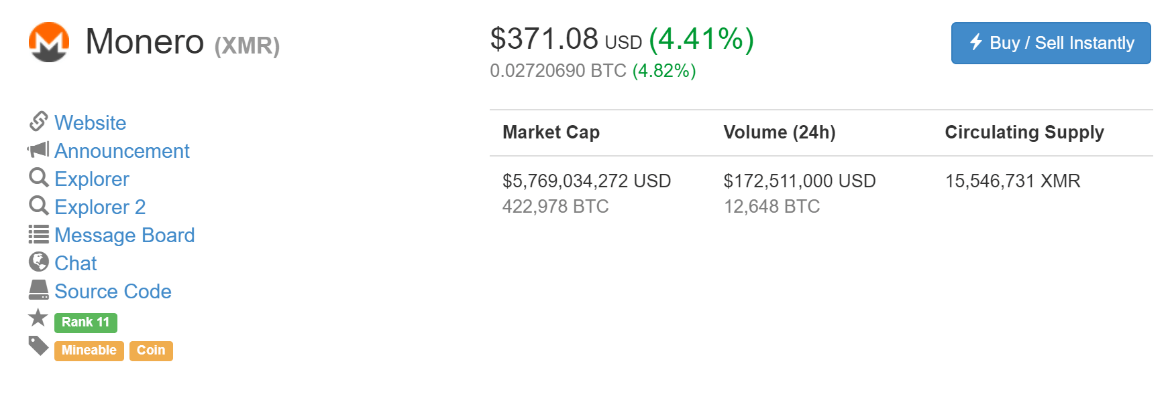

In this example, we’ll look at the ticker Monero (XMR) / Bitcoin (BTC) or simply XMRBTC. In other words, I’m using BTC to buy XMR. The price of a Monero is quoted in BTC rather than USD. It’s current price of 0.025 simply means that with it costs you 0.025 BTC to buy 1 XMR. This “price” is just a ratio between the value of BTC against the value of XMR (the USD value of BTC was $14,800 while XMR was $370, which gives a ratio of 0.025). (See also: Guide on Privacy Coins: Comparison of Anonymous Cryptocurrencies)

The reason why it can get complicated is that we’re used to buying stuff pegged on our domestic currency, and pegging the altcoins we want to buy with BTC requires you to know the value of BTC in USD at that specific moment as well as the value of XMR at that specific moment.

How to Recognize Your Gains?

Following the above example, there are 2 ways that you can monitor your gains (or losses):

1. Valuing Your Coins in USD

When you’ve used your 0.025 BTC to buy 1 XMR, you monitor the USD value of your XMR. This means valuing your XMR in USD value only, making it easier for you to calculate your gains. There are many applications and resources that allow you to do that, and Coin Market Cap is a popular resource:

So, if your XMR increases to $500 in the future, you know that you’ve made $130 from your initial investment of $370, giving you a great return of over 35%.

2. Valuing Your Coins in a Base Currency

The main purpose of valuing your coins using a base currency (most commonly BTC) is to increase the number of coins you hold. Following the above example, if say you bought 1 XMR using 0.025 BTC and the price (or ratio) of XMR/BTC increases to 0.030 sometime in the future, it means that your XMR has increased by 20%. This also means that you can buy 20% more Bitcoin using your XMR. If you decide to sell your XMR for BTC, you’d have 0.03 BTC, which is 20% more than when you first started with 0.025 Bitcoin. And just like that, you’ve increased the number of coins you’re holding!

Useful Resources

If you're on your way to buying your coins, here's a list of useful guides and resources to get you started:

Trading & Exchange

- Crypto Guide 101: Choosing The Best Cryptocurrency Exchange

- Guide to Bittrex Exchange: How to Trade on Bittrex

- Guide to Binance Exchange: How to Open Binance Account and What You Should Know

- Guide to Etherdelta Exchange: How to Trade on Etherdelta

Wallets

- Guide to Cryptocurrency Wallets: Why Do You Need Wallets?

- Guide to Cryptocurrency Wallets: Opening a Bitcoin Wallet

- Guide to Cryptocurrency Wallets: Opening a MyEtherWallet (MEW)

Stay Safe!

You might also be interested in A Guide To Fundamental Analysis For Cryptocurrencies & Beginner’s Guide to ICO Investing: How to Participate in ICOs

Get our exclusive e-book which will guide you through the step-by-step process to get started with making money via Cryptocurrency investments!

You can also join our Facebook group at Master The Crypto: Advanced Cryptocurrency Knowledge to ask any questions regarding cryptos!

I'm Aziz, a seasoned cryptocurrency trader who's really passionate about 2 things; #1) the awesome-revolutionary blockchain technology underlying crypto and #2) helping make bitcoin great ‘again'!