Some of the links in this post are from our sponsors. We provide you with accurate, reliable information. Read our Advertising Disclosure.

Article Overview: This guide will cover everything you need to know about Bittrex exchange and how to trade on Bittrex exchange.

You’re extremely interested to purchase your first altcoins and you’re in the process (or have already) of opening a cryptocurrency exchange.

However, the complexity of buying cryptos can be daunting for many who do not have a financial or trading background. Don’t worry!

This guide will provide you with the necessary skills to buy and sell cryptocurrencies easily. (See also: 4 Reasons Why Now is the Best Time for You to Invest in Cryptocurrencies)

For this guide, we’ll be mainly using Bittrex exchange since it is the biggest Crypto -accepting exchange, with over 1 billion dollars in daily trading volume.

Most other exchanges share the same functionalities and therefore, the trading process is similar.

Learn How to Make Over 100% Returns Investing in Crypto

Step 1: Buy Bitcoin/Ethereum

Ensure that you’ve already bought Bitcoin (BTC) or Ether (ETH) from your local, crypto exchange that accepts your local currency.

Bitcoin and Ether are the biggest coins that represent the base currency for the crypto world; buying any of the 1,300+ altcoins available requires the use of BTC/ETH since you cannot usually buy altcoins using your local currency.

A popular exchange is Coinbase, which is easy to use for beginners but has relatively higher fees. Alternatively, you can check out Local Bitcoin, which is a peer-to-peer marketplace.

Recommendation: Ethereum can process much more transactions than Bitcoin, therefore making the transfer and confirmation times much faster. On average, you’d usually wait for a few minutes for your ETH transfer while BTC transfers can take hours. Additionally, the transfer fees are much smaller using ETH than BTC.

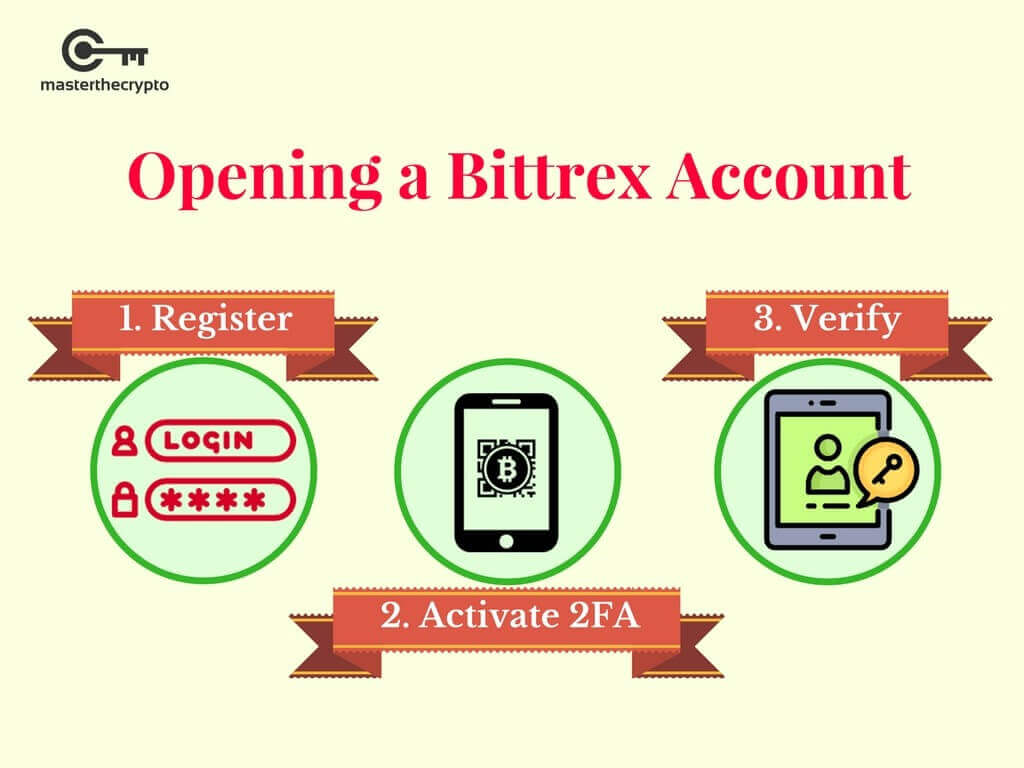

Step 2: Open a Bittrex Account

Open a Bittrex account by registering your name and email, and make sure you activate 2-factor authentication to further secure your account against hacks.

The next thing to do is to verify your account by furnishing your personal information and your official identification documents.

Verifying yourself allows you to increase your withdrawal limit from 0.4 BTC to 100 BTC saving you lots of headache for future withdrawals. You can follow the verification guide here.

Step 3: Deposit Base Currency

You can now deposit the BTC/ETH that you’ve bought from your local exchange to your newly-opened Bittrex account.

You will use the base currency to buy the altcoins of your choice. For a detailed process on how to deposit your BTC/ETH, please follow this guide here.

Step 4: Choose Your Base Currency Market

There are 3 markets in Bittrex:

- Bitcoin Market

- Ethereum Markets

- USDT Markets

These 3 markets are represented by the common base currencies used to buy the wide variety of altcoins available.

If you deposited BTC as your base currency, then got to the Bitcoin Market and pick an altcoin that you want to buy using Bitcoin. If you deposited ETH on the other hand, pick the altcoins of your choice in the Ethereum Market.

Step 5: Setting Buy Orders

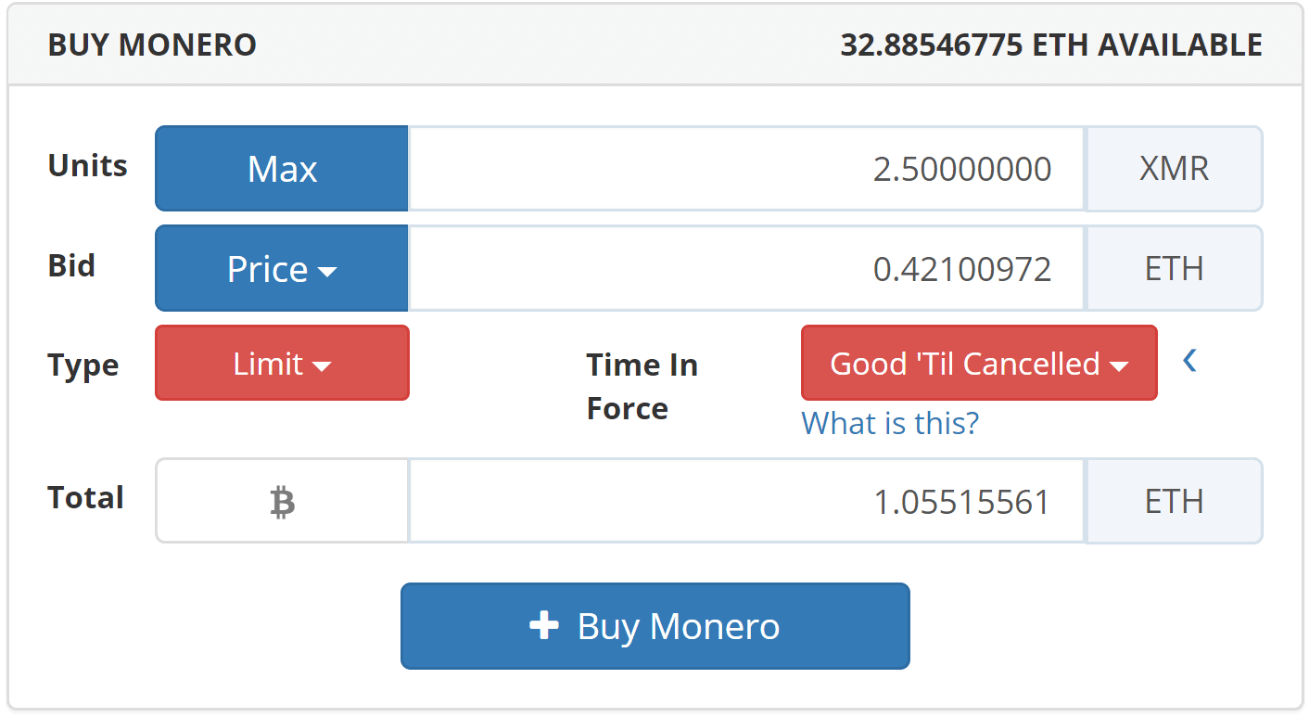

Enter the details of your buy orders in the “Buy” box under the trading section. Assume that you’re buying Monero (XMR) using ETH:

Tip: It is not compulsory to buy exactly 1 unit of Cryptocurrency as they are highly divisible. You can buy/sell any amounts you wish, depending on your budget. So, you can buy 0.000001 Bitcoin without worry!

Units: The quantity/amount of coins that you want to buy. In this example, the amount of Monero that you would buy is 2.50

Bid: The price that you’re willing to pay per unit of Monero. Following the example, the price that you’re willing to pay for 1 Monero is 0.42100972

Type: This refers to the order type, which consists of a “Limit” (default order) or “Conditional” Order. “Limit” order sets the maximum price (as stated in the “Bid”) that you’re willing to buy. This guarantees that you’ll pay no more than 0.42100972 ETH for 1 Monero.

“Conditional” orders are more complex as it is only added to the public order book once the prices reach the defined “Conditional” prices you set. Unless you know what you’re doing, stick with “Limit” orders

Total: The total amount of base currency (in this case, ETH) that you will give up in exchange for the total number of altcoins you want to buy. Alternatively, this is the total cost of buying Monero using your base currency of ETH

Tip: Conditional order is used when you do not want your orders to show up on the Order book, which lists all active buy and sell orders. Only when the prices reached the conditional price that you set will the orders be public. It’s like a “ninja order”, used usually by investors that are buying a huge amount of coins and do not want anyone to know that they’re placing a huge order so as to not influence the price.

Step 6: Setting Sell Orders

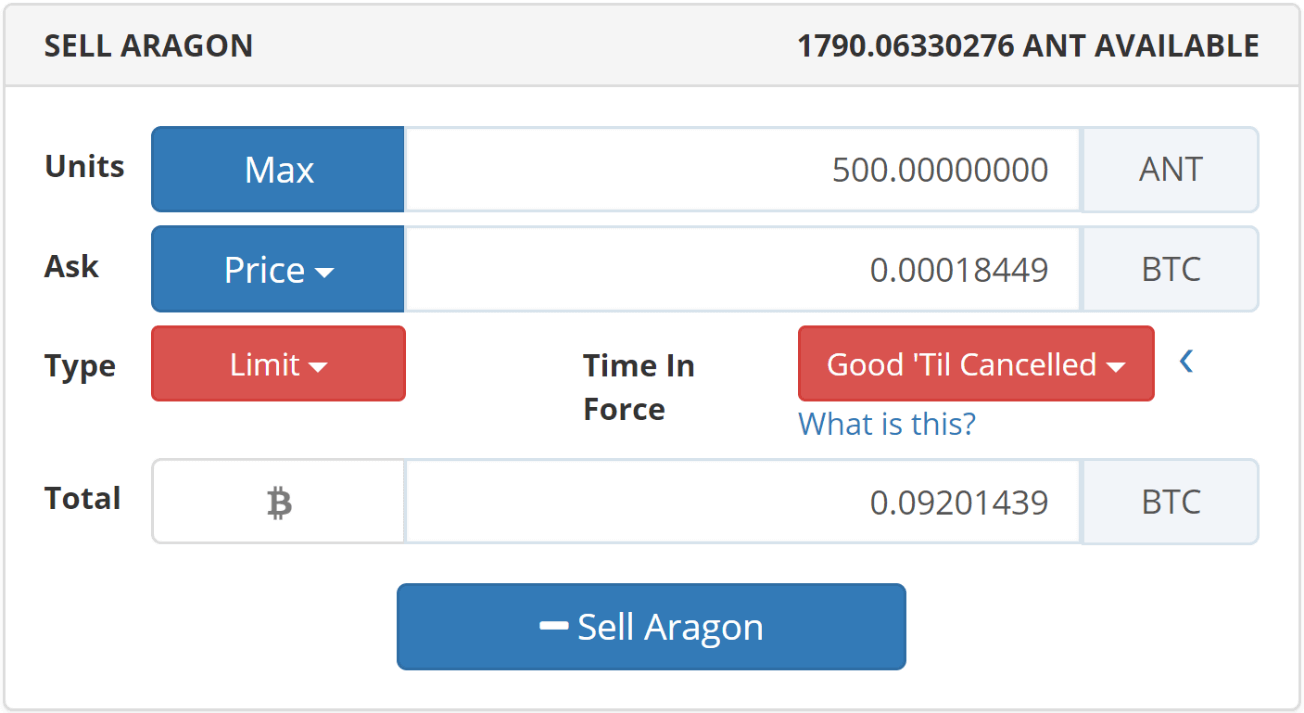

Enter the details of your sell orders in the “Buy” box under the trading section. Assume that you’re selling Aragon (ANT) and being paid in BTC:

Units: The quantity/amount of coins that you want to sell, in exchange for the base currency of BTC. In this example, the amount of Aragon (ANT) that you would sell is 500 coins

Ask: The price that you’re willing to sell per unit of Aragon, quoted in BTC. Following the example, the price that you’re willing to sell for 1 ANT (quoted in BTC) is 0.00018449

Type: This refers to the order type, which consists of a “Limit” (default order) or “Conditional” Order. “Limit” order sets the minimum price (as stated in the “Bid”) that you’re willing to sell. This guarantees that you’ll receive no less than 0.00018449 BTC for 1 ANT

“Conditional” orders are more complex as it is only added to the public order book once the prices reach the defined “Conditional” prices you set. Unless you know what you’re doing, stick with “Limit” orders

Total: The total amount of base currency (in this case, BTC) that you will receive in exchange for the total number of altcoins you want to sell. Alternatively, this is the total amount that you’ll be getting (quoted in BTC) by selling ANT

Important: The price of the coin you want to buy/sell at (Bid/Ask) is denominated in a base currency which can either be USD, BTC or ETH. Denominations in USD is easy since it gives you the numerical market price (e.g. buying Ripple at $0.30), but denominations in BTC/ETH can be tricky at first as you’re buying the ratio of Ripple in comparison with BTC/ETH. For instance, the price of Ripple compared to BTC (XRP/BTC pair) can be 0.000024, since Ripple’s price is compared to Bitcoin’s price to form the ratio that you see.

Final Step: Storing All Coins in a Wallet

The most secure way of storing your coins is through having your personal wallets. Although you would automatically have a wallet when you open an exchange account (exchange-hosted wallet), you do not have control of the private and public keys.

Having control of your keys means having control of your coins. Exchanges work like a bank; it is a third-party service provider that you trust to keep your coins safe.

However, there is always a probability of the exchange shutting down or being hacked, resulting in a loss of coins (case in point: Mount Gox exchange).

Given the lack of regulatory frameworks on exchanges and cryptocurrencies as a whole, as well as the infancy of the industry, the best way to keep your coins safe is to have total control of your coins.

You can only have absolute control by having your own wallet.

Additional Information

Under the “Bid” price, there are 3 types of Bids that are:

- Last: The last price at which the last trade occurred

- Bid: The highest price a buyer is willing to pay for the coin, which is seen as the first order in the “Order Book” section, under “Bids”

- Ask: The lowest price a seller is willing to sell the coin at, which is seen as the first order in the “Order Book” section, under “Ask”

If you were to create your own orders by inputting the “Bid” amount, then this doesn’t apply to you. The 3 categories above is for those that are lazy to input their numbers manually and would like to just pick the closest price from the order book.

How to Invest in Crypto for HUGE PROFITS

Sign up below to get access to our FREE eBook "Complete Guide to Crypto Analysis"

I'm Aziz, a seasoned cryptocurrency trader who's really passionate about 2 things; #1) the awesome-revolutionary blockchain technology underlying crypto and #2) helping make bitcoin great ‘again'!